z-x.site Market

Market

Basket Ball Hoop Price

Heavy dury basketball hoop full station in Chestermere, AB. CA$ Heavy dury basketball hoop full station ; Basketball Hoop with stand in Calgary, AB. CA$ UBALL is a new grass /sand version of basketball. Take this hoop anywhere and set it up in minutes UBALL Lite Best Seller. Regular price $ Sale price $ Mural X5 basketball hoop. 2,$ Add to cart · Street hoop basketball hoop. 2,$ Add to cart · King Hoop Basketball hoop. 2,$ Add to cart. Factory price professional custom design Official nba hydraulic basketball hoop, including official nba basketball hoop,official basketball hoop height. Deluxe Plastic Floor Basketball Set. Was $ ; Heavy Duty Anti-Whip Polyester Basketball Net. Was $ ; Floor Basketball Set · Was $ ; Mini Steel. How much does a Basketball System cost? A typical price for a Basketball System is $ but can range from approximately $58 to $ What are the most. Lifetime Powerlift 54” Basketball System. Sign In For Price. After $ OFF. Lifetime Powerlift 54” Basketball System. Features a clear 54” steel framed. Basketball Hoops, Nets & Posts ; FORZA Adjustable Basketball Systems | Net World Sports · FORZA Adjustable Basketball Hoop And Stand System · $ ; FORZA Mini. Basketball Hoops ; DC72EI · $3, ; CV72S · $3, ; Fixed Height · $3, ; CV72 · $3, ; CV60S · $3, Heavy dury basketball hoop full station in Chestermere, AB. CA$ Heavy dury basketball hoop full station ; Basketball Hoop with stand in Calgary, AB. CA$ UBALL is a new grass /sand version of basketball. Take this hoop anywhere and set it up in minutes UBALL Lite Best Seller. Regular price $ Sale price $ Mural X5 basketball hoop. 2,$ Add to cart · Street hoop basketball hoop. 2,$ Add to cart · King Hoop Basketball hoop. 2,$ Add to cart. Factory price professional custom design Official nba hydraulic basketball hoop, including official nba basketball hoop,official basketball hoop height. Deluxe Plastic Floor Basketball Set. Was $ ; Heavy Duty Anti-Whip Polyester Basketball Net. Was $ ; Floor Basketball Set · Was $ ; Mini Steel. How much does a Basketball System cost? A typical price for a Basketball System is $ but can range from approximately $58 to $ What are the most. Lifetime Powerlift 54” Basketball System. Sign In For Price. After $ OFF. Lifetime Powerlift 54” Basketball System. Features a clear 54” steel framed. Basketball Hoops, Nets & Posts ; FORZA Adjustable Basketball Systems | Net World Sports · FORZA Adjustable Basketball Hoop And Stand System · $ ; FORZA Mini. Basketball Hoops ; DC72EI · $3, ; CV72S · $3, ; Fixed Height · $3, ; CV72 · $3, ; CV60S · $3,

Deluxe Plastic Floor Basketball Set. Was $ ; Heavy Duty Anti-Whip Polyester Basketball Net. Was $ ; Floor Basketball Set · Was $ ; Mini Steel. Spalding Basketball Hoops ; Spalding 60" Heavy Duty Foam Board Pad for 1x2" Basketball Hoop Backboard · $ Free shipping. 15 watching ; fw23 Supreme. Shop now to reach new heights with Academy Sports + Outdoors. Discover basketball hoops & goals designed to elevate your basketball game and find victory. Basketball Systems · Basketballs · Basketball Parts. Sort By: Featured Items, Newest Items, Best Selling, A to Z, Z to A, By Review, Price: Ascending, Price. Price Low To High; Price High To Low; Name Ascending; Name Descending. Sort Now THE BEAST PORTABLE BASKETBALL HOOP. $1, - $2, Go to reviews. Find the best prices on basketball hoops at Dunham's Sports. From in-ground hoops to mounted hoops, get the basketball hoop you need. Shop now to reach new heights with Academy Sports + Outdoors. Discover basketball hoops & goals designed to elevate your basketball game and find victory. Basketball Hoop - 60" Backboard · $2, · $2, Find the lowest prices on Portable basketball hoop ✓ See 71 top models ✓ Discover deals now. Marketplace › Sporting Goods › Sports Equipment › Basketball Gear › Basketball Hoops. Basketball Hoops. Create new listing. Filters. Price. The average price for Basketball Goals ranges from $20 to $2, Dr. Dish iC3 Basketball Shot Trainer · $ ; Goalsetter MVP 72" In Ground Basketball Hoop - Glass Backboard Goalsetter MVP 72 · $2, ; Goalsetter Captain. Dream Big Play Hard Limited Edition Door Mount Hoop Set. $ ; Mini Pro Basketball Hoop Set. Reviews. $ ; Mini Pro Dura Goal Hoop Set. 71 Reviews. Basketball. Hoops ; Silver Basketball Hoop - City Hoops · Silver Basketball Hoop. $2, USD ; Gold Basketball Hoop - City Hoops · Gold Basketball Hoop. From. The average price for Basketball Goals ranges from $20 to $2, $9, · When will I receive my huupe PRO? · What if I already have a basketball hoop and want to replace it with the huupe PRO? · Can I purchase the huupe PRO if. Best Price Guarantee! Financing Options Available; FREE & FAST Shipping! No Sales Tax for nearly all states; Questions? We. Find the best prices on basketball hoops at Dunham's Sports. From in-ground hoops to mounted hoops, get the basketball hoop you need. $2, Original price was: $2, $2, Best-selling Basketball Hoops ; Franklin Sports Pro Hoops Basketball. $ ; Spalding Arena Slam Over-The-Door Basketball Hoop. $ ; B. sports Wooden.

Best Dating App In India For Serious Relationship

Best dating apps in India () ; Bumble, /5 ; Tinder, /5 ; Happn, /5 ; Mingle2, /5 ; Aisle, /5. Tinder is very popular for casual dating, but Aisle is great for those that want a long-term relationship. And there are also apps like Hinge or Bumble that can. Aisle connects people of Indian or South Asian origin from around the globe to build a community that believes in long-lasting relationships. It has staked its. Bumble Dating App: Meet & Date is the top Grossing Dating Android app in India for September 4, since it's ranking did not change by 0 positions since last. Bumble wins the overall popularity contest, but you also want to consider how popular a dating app is with people in the age range you want to date. The largest. z-x.site is the largest website for Indian singles looking for dating for long-term relationships Our Most Popular Dating Apps By. Community. Bengali. The dating app to meet new people and build equitable relationships. Bumble is the dating app with millions of people to meet and find dates. What the App is about: In its brand positioning, Aisle is an app made for Indians looking for serious relationships. Pros: Filters for ultra-specific. Gleeden - This dating app caters to people in committed relationships looking for a bit of excitement on the side. MEET NEW PEOPLE. JOIN NOW. Best dating apps in India () ; Bumble, /5 ; Tinder, /5 ; Happn, /5 ; Mingle2, /5 ; Aisle, /5. Tinder is very popular for casual dating, but Aisle is great for those that want a long-term relationship. And there are also apps like Hinge or Bumble that can. Aisle connects people of Indian or South Asian origin from around the globe to build a community that believes in long-lasting relationships. It has staked its. Bumble Dating App: Meet & Date is the top Grossing Dating Android app in India for September 4, since it's ranking did not change by 0 positions since last. Bumble wins the overall popularity contest, but you also want to consider how popular a dating app is with people in the age range you want to date. The largest. z-x.site is the largest website for Indian singles looking for dating for long-term relationships Our Most Popular Dating Apps By. Community. Bengali. The dating app to meet new people and build equitable relationships. Bumble is the dating app with millions of people to meet and find dates. What the App is about: In its brand positioning, Aisle is an app made for Indians looking for serious relationships. Pros: Filters for ultra-specific. Gleeden - This dating app caters to people in committed relationships looking for a bit of excitement on the side. MEET NEW PEOPLE. JOIN NOW.

Top 5 dating apps Tinder: Known as one of the highly popular dating apps across the globe, Tinder has been popular in India in recent years with an. With Happn's concept of the users meeting in real life to know each other better, it is the best dating site for serious relationships if that is what you are. We met through Gofordesi app, it's a great platform to find your partner, reliable and trustworthy site. Thank you, Gofordesi. Indian Dating in USA, UK, Canada. We are the top platform for Indian singles in your area. Whether you're interested in dating, friendship, or a serious relationship, our app can help you. Our Top Dating Apps And Sites For Serious Relationships · Best Versatility: Bumble · Best for Most Widely-Used: Tinder · Best for Efficiency: Coffee Meets Bagel. The dating app for serious daters. Plus, we've been named one of the best dating apps for relationships, with over million matches and counting. So, go with tinder eharmony good for professionals, elite singles match: best dating for professionals – elitesingles best dating apps for you with us. Be on. WooPlus, the best BBW dating app, plays the cupid for big beautiful women and people who admire curvy singles. Free to join, meet and date plus size women. One of the best perks of Facebook Dating is the app's dedication to the user's experience. Sometimes privacy is hard to find on dating apps, so Facebook Dating. Best for Long-Term Relationships. Match · Robust, vetted profiles · Expensive; Profile approval isn't instant ; Best for Casual Dating. Tinder · Simple, modern. Tinder is the most popular dating app in India with a rapidly growing user base. It asks you to signup using your Facebook account and fetches a basic profile. And with the legalization of same-sex and queer relationships in the country, apps such as OkCupid, Tinder, Bumble, and Grindr became inclusive. They added. The DesiKiss is seeing popularity in India and is good for those who usa just entering the dating scene as well as those looking dating a serious commitment. z-x.site is the largest website for Indian singles looking for dating for long-term relationships Our Most Popular Dating Apps By. Community. Bengali. Top 10 dating apps in India · 1-Tinder: It is the most popular dating application around the world, you must have seen its ads. · 2-Aisle: This application is. We are the top platform for Indian singles in your area. Whether you're interested in dating, friendship, or a serious relationship, our app can help you. If you're on a quest for lasting love and seeking the ideal Indian dating website in India, look no further than z-x.site With its comprehensive platform. TrulyMadly, Quack Quack, Coffee Meets Bagel, FriendlyMoney, Tinder, Badoo, Dil Mil Match,Making24, Woo Top 12 Best Dating Apps in India. eharmony is a dating site with over 20 year's experience. Our matching helps you to find real love. Sign up for free and meet thousands of like-minded.

Home Depot Credit Card Limit

Alerts will come from The Home Depot® Credit Card Alerts, and you can Password restrictions. Don't use your name or User ID as your Password. Don't. Amount Over Credit Limit. $ Statement Closing Date. 11/19/ HOME DEPOT CREDIT SERVICES. PO Box , St. Louis, MO Customer Service. The Home Depot® Credit Card's maximum credit limit is around $25,, according to user reports. Citibank does not disclose any specific credit limit. You are requesting that your Lender issue you a Project Loan Card if your credit application is approved. limit, loan status, the repayment period. Visit the Home Depot Credit Cards page to pay and manage your card. You haven't saved any credit cards. Add a credit card for quick and easy checkout the next. Neither The Home Depot Consumer Credit Card nor The Home Depot Commercial Revolving Charge Card can be accepted as payment for a Gift Card purchase. Once. Note: So for example If you get approved for any Home Depot card, you will receive a credit limit of at least $ Just bear in mind that the. Manage your Home Depot Canada credit card account online, any time, using any device. Submit an application for a Home Depot credit card now. It offers 0% interest for six months on projects over $ and offers credit limits up to $55, for those who qualify. Home Depot credit card and home. Alerts will come from The Home Depot® Credit Card Alerts, and you can Password restrictions. Don't use your name or User ID as your Password. Don't. Amount Over Credit Limit. $ Statement Closing Date. 11/19/ HOME DEPOT CREDIT SERVICES. PO Box , St. Louis, MO Customer Service. The Home Depot® Credit Card's maximum credit limit is around $25,, according to user reports. Citibank does not disclose any specific credit limit. You are requesting that your Lender issue you a Project Loan Card if your credit application is approved. limit, loan status, the repayment period. Visit the Home Depot Credit Cards page to pay and manage your card. You haven't saved any credit cards. Add a credit card for quick and easy checkout the next. Neither The Home Depot Consumer Credit Card nor The Home Depot Commercial Revolving Charge Card can be accepted as payment for a Gift Card purchase. Once. Note: So for example If you get approved for any Home Depot card, you will receive a credit limit of at least $ Just bear in mind that the. Manage your Home Depot Canada credit card account online, any time, using any device. Submit an application for a Home Depot credit card now. It offers 0% interest for six months on projects over $ and offers credit limits up to $55, for those who qualify. Home Depot credit card and home.

If your purchase was made with The Home Depot Consumer Credit Card, The Home Limit the Use of My Sensitive Personal Information|; Do Not Sell or. If you want to increase your credit limit with your Home Depot credit card, there are a few steps to follow. You will need to email customer service, which can. Home Depot Project Loan vs. Home Depot Consumer Credit Card ; Maximum amount. $55, Varies ; APR. %, %, % or %. %, %, %, or. Shop at thousands of retailers, in-store or online, with the Synchrony HOME Credit Card and take advantage of promotional financing today! Every $1 spent on your card counts as $4 for purposes of earning Perks. There are minimum spend thresholds and limits to the amount of Perks that you may earn. Maximize your cash back with categories that fit your needs · Gas & EV Charging Stations · Online Shopping · Dining · Travel · Drug Stores · Home Improvement &. However, we understand that some customers may wish to limit store visits during COVID Consumer Credit Card. Make Everyday Home Improvements with The Home. Yes, you can increase your Home Depot Credit Card limit by calling Home Depot customer service or applying online through your account. . Does Home Depot offer. Every $1 spent on your Pro Xtra Credit Card counts as $4 for purposes of earning Perks. There are minimum spend thresholds and limits to the number of Perks. Be careful not to select the other Home Depot credit card, the Pro Xtra Credit Card. credit limit of at least $1, at the Home Depot store. Use. We were going to make a large purchase and found out they lowered the limit to $ which which was exactly what our balance was so our utilization was maxed. Can I buy multiple Gift Cards at once? Yes, you may purchase up to The Home Depot® Gift Cards totaling up to $ per day. If you need more than $ and. Yes, the Home Depot Consumer Card has a credit limit. It is based on your creditworthiness and will be given to you upon approval. It can change at any time, so. z-x.site #smart choice for insurance · Types of Home Depot Credit Cards · Consumer Credit Card · Project Loan Card · Commercial Revolving Charge. Current ProPurchase® participants may shop at The Home Depot® retail stores nationwide, using your HD Supply line of credit · 1. Who is eligible for the. Your billing statement also shows your transactions; the Minimum. Payment Due and payment due date; your credit limit; and your interest charges and fees. On. The Home Depot ® Consumer Credit Card offers financing on select purchases. Apply for a Home Depot ® Credit Card and extend your budget for making home. How to Use Other Payment Methods at Home Depot. In-Store: Use your credit/debit card or PayPal at checkout. For PayPal, scan the QR code if available. Visit the Home Depot credit card website. · Fill in the application form. You will typically need to provide general financial information, such as your Social. I am unable to complete the enrollment process due to eligibility, why? There are restrictions on who may enroll their The Home Depot Commercial Credit Card for.

Put Put Course

putting experience. Perfect for family, friends, couples or work outings As one of the nation's largest miniature golf courses, Dinosaur Adventure Golf. A challenging put-put golf course full of historical realities about the War of discovered on each of its 18 holes. We've rewritten the rules of mini golf – pairing modern tech with crazy courses and cool vibes with game faces for one hell of a good time. Is this your listing? Miniature Golf Course is an unclaimed page. Claim it for free to: Update listing information. Respond to reviews. Add business hours. Play the course that started it all. The oldest and most iconic golf course in the world. The Swilcan Bridge and Hell Bunker are recognised across the globe. The only mini-golf course on the island, this game is positively historic! Learn all about the battles of the War or while enjoying the Put in Bay. Full Size Driving Range - 11 Hole Pitch & Putt Golf Course · Practice, play and have fun! · Golf lesson packages · Hours of operation. Green fees price ranges · Week days: $10 · Weekends: $ Course policies. Metal spikes allowed: No; Dress code: No dress code. The War of 18 Holes Miniature Golf Course is the only mini golf course on Put-in-Bay. Learn all about the battles of the War of while improving your. putting experience. Perfect for family, friends, couples or work outings As one of the nation's largest miniature golf courses, Dinosaur Adventure Golf. A challenging put-put golf course full of historical realities about the War of discovered on each of its 18 holes. We've rewritten the rules of mini golf – pairing modern tech with crazy courses and cool vibes with game faces for one hell of a good time. Is this your listing? Miniature Golf Course is an unclaimed page. Claim it for free to: Update listing information. Respond to reviews. Add business hours. Play the course that started it all. The oldest and most iconic golf course in the world. The Swilcan Bridge and Hell Bunker are recognised across the globe. The only mini-golf course on the island, this game is positively historic! Learn all about the battles of the War or while enjoying the Put in Bay. Full Size Driving Range - 11 Hole Pitch & Putt Golf Course · Practice, play and have fun! · Golf lesson packages · Hours of operation. Green fees price ranges · Week days: $10 · Weekends: $ Course policies. Metal spikes allowed: No; Dress code: No dress code. The War of 18 Holes Miniature Golf Course is the only mini golf course on Put-in-Bay. Learn all about the battles of the War of while improving your.

place mostly to ourselves (which is a good thing since the courses were the putt-putt golf course if 15 feet wide and feet long and everything. The only mini-golf course on the island, this game is positively historic! Learn all about the battles of the War or while enjoying the Put in Bay. Youth on Course provides young people with access to life-changing opportunities through golf. Members have access to play rounds of golf for $5 or less at. The Official Site of Drive, Chip & Putt, a free nationwide junior skills competition open to boys and girls ages , is an initiative created by the. Central Park Pitch & Putt is open for play daily from 40 minutes after sunrise to dusk (weather depending). If your call to the course is unanswered. Saunders Golf Course is a fun and challenging Par 3 located just outside of downtown Put-in-Bay. Experts and novices alike love playing the nine hole. We have designed our 9 hole course to adapt to interior spaces if the weather is cold and wet. Mobile Putt Putt is unique and will make your event memorable. Mini Golf Courses cost less than 1% of an actual size golf course. Most Putt Golf | Putting Golf | Fun Golf | Love Golf | Small Golf. WHAT WE OFFER. Looking for something to do in Naples or Marco Island?, try Naples Miniature Golf. Offering two separate 18 hole mini golf courses, the Cave Course and the. Putt Putt Mermaid Beach is the ultimate mini golf experience located on the Gold Coast. Discover a hole world of fun day or night. Award-Winning 18 Hole Championship Golf Course in Plymouth, MA. Voted 5 Stars “Best of” Weddings & Bride's Choice Awards 10 years in a row! Greenlake Pitch & Putt. PRICES. REGULAR - $ JUNIORS (Age 17 Feel free to send us photos, we may add them to our Instagram page per your approval. Put in Bay Golf Courses · Saunders Golf Course, Saunders Course · Catawba Island Club, Catawba Island Course · Erie Islands Resort, Little Nessie Par-3 Course. We have designed our 9 hole course to adapt to interior spaces if the weather is cold and wet. Mobile Putt Putt is unique and will make your event memorable. ⛳️ Mini golf passes can be found in our print or online guide to try out the new put put course! #nicksminigolf #visitrehoboth #rehobothbeach #delaware. Golfland is the perfect place to host your next group outing. Book your event online now! Find Out More. adults playing putt putt mini golf. Your Family. multi-sport simulators, mini bowling, and a challenging putting course. Unwind at our restaurant and sports bar after an exciting day of play. Put in Bay Golf Courses · Saunders Golf Course, Saunders Course · Catawba Island Club, Catawba Island Course · Erie Islands Resort, Little Nessie Par-3 Course. Put In Bay Golf Courses: Saunders GC: #2 Saunders Golf Course Put-In-Bay, Ohio Public/Resort 1 Write Review Golf Courses Near Put In Bay.

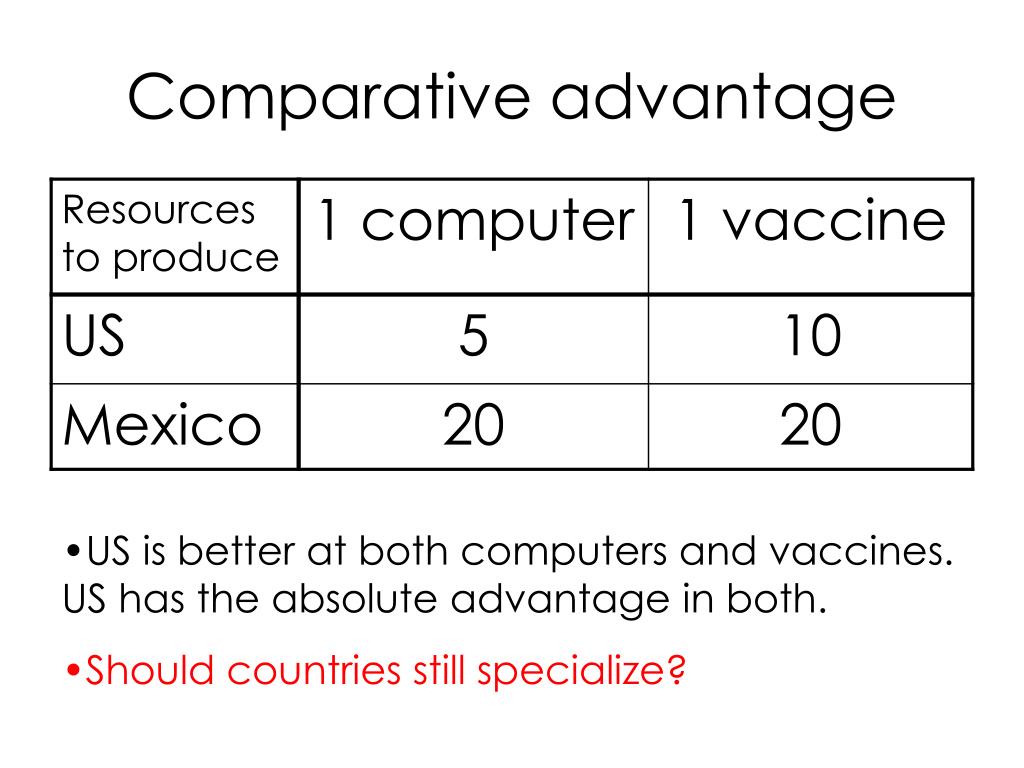

What Is Comparative Advantage

Comparative advantage is a powerful tool for understanding how we choose jobs in which to specialize, as well as which goods a whole country produces for export. Have you ever heard of “absolute advantage”? What about “opportunity cost”? Certainly you're familiar with “comparative advantage”? Have you ever explored a “. Comparative advantage in an economic model is the advantage over others in producing a particular good. A good can be produced at a lower relative. Absolute Advantage: The ability of an actor to produce more of a good or service than a competitor. Comparative Advantage: The ability of an actor to produce a. What Is Comparative Advantage? A person has a comparative advantage at producing something if he can produce it at lower cost than anyone else. Having a. Experts of economics fundamentally define comparative advantage as the upper hand that individual gains when producing specific goods over another. In economics, a comparative advantage occurs when a country can produce a good or service at a lower opportunity cost than another country. Comparative advantage generally refers to the fact that different countries possess different inherent advantages such as low-cost labor, advanced technology. Key Takeaways · Comparative advantage is an economy's ability to produce a particular good or service at a lower opportunity cost than its trading partners. Comparative advantage is a powerful tool for understanding how we choose jobs in which to specialize, as well as which goods a whole country produces for export. Have you ever heard of “absolute advantage”? What about “opportunity cost”? Certainly you're familiar with “comparative advantage”? Have you ever explored a “. Comparative advantage in an economic model is the advantage over others in producing a particular good. A good can be produced at a lower relative. Absolute Advantage: The ability of an actor to produce more of a good or service than a competitor. Comparative Advantage: The ability of an actor to produce a. What Is Comparative Advantage? A person has a comparative advantage at producing something if he can produce it at lower cost than anyone else. Having a. Experts of economics fundamentally define comparative advantage as the upper hand that individual gains when producing specific goods over another. In economics, a comparative advantage occurs when a country can produce a good or service at a lower opportunity cost than another country. Comparative advantage generally refers to the fact that different countries possess different inherent advantages such as low-cost labor, advanced technology. Key Takeaways · Comparative advantage is an economy's ability to produce a particular good or service at a lower opportunity cost than its trading partners.

Simplified explanation of comparative advantage with examples and criticisms. Comparative advantage occurs when one country can produce a good or service at. Comparative advantage is an economic theory. Comparative advantage itself is an economy's ability to produce a good or service at a lower opportunity cost than. A country with an absolute advantage in some product has higher labor productivity than another country does in the production of that product. Option #2 is the best choice as it maximizes production and utility for both countries because each country produces the item in which they have a comparative. Comparative advantage is an economic theory created by British economist David Ricardo in the 19th century. It argues that countries can benefit from trading. Comparative advantage is an economy's ability to produce a particular good or service at a lower opportunity cost than its trading partners. According to the principle of comparative advantage, the gains from trade follow from allowing an economy to specialise. If a country is relatively better at. The meaning of COMPARATIVE ADVANTAGE is the advantage enjoyed by a person or country in the cost ratio of one commodity to another in comparison with the. Comparative advantage Comparative advantage is a term economists use, especially in international trade. A country has a comparative advantage when it can. Comparative advantage is the ability of a person, company, or country to produce a good or service at a lower opportunity cost than another producer. A country is said to have a comparative advantage in production of a good if it has lower opportunity costs in producing this good compared to another. According to the principle of comparative advantage, the gains from trade follow from allowing an economy to specialise. If a country is relatively better at. Competitive advantage is a company's ability to offer products or services with better quality, pricing or both when compared to its competitors. Comparative advantage stipulates that countries should specialize in a certain class of products for export, but import the rest. Comparative advantage is an economic principle that explains how trade can benefit two countries or entities even if one of them has an absolute advantage. Comparative advantage argues that free trade works even if one partner in a deal holds an absolute advantage in all areas of production. Competitive Advantage results when a strategy is put in place that differentiates an organization from another. Comparative advantage occurs when economies. This note examines comparative advantage in monetary economies. It shows that in monetary economies, short run monetary conditions may cause short run trade. Comparative advantage means that you and someone else have different performance or skills and by splitting the tasks you need to do results. A country has an absolute advantage in those products in which it has a productivity edge over other countries; it takes fewer resources to produce a product. A.

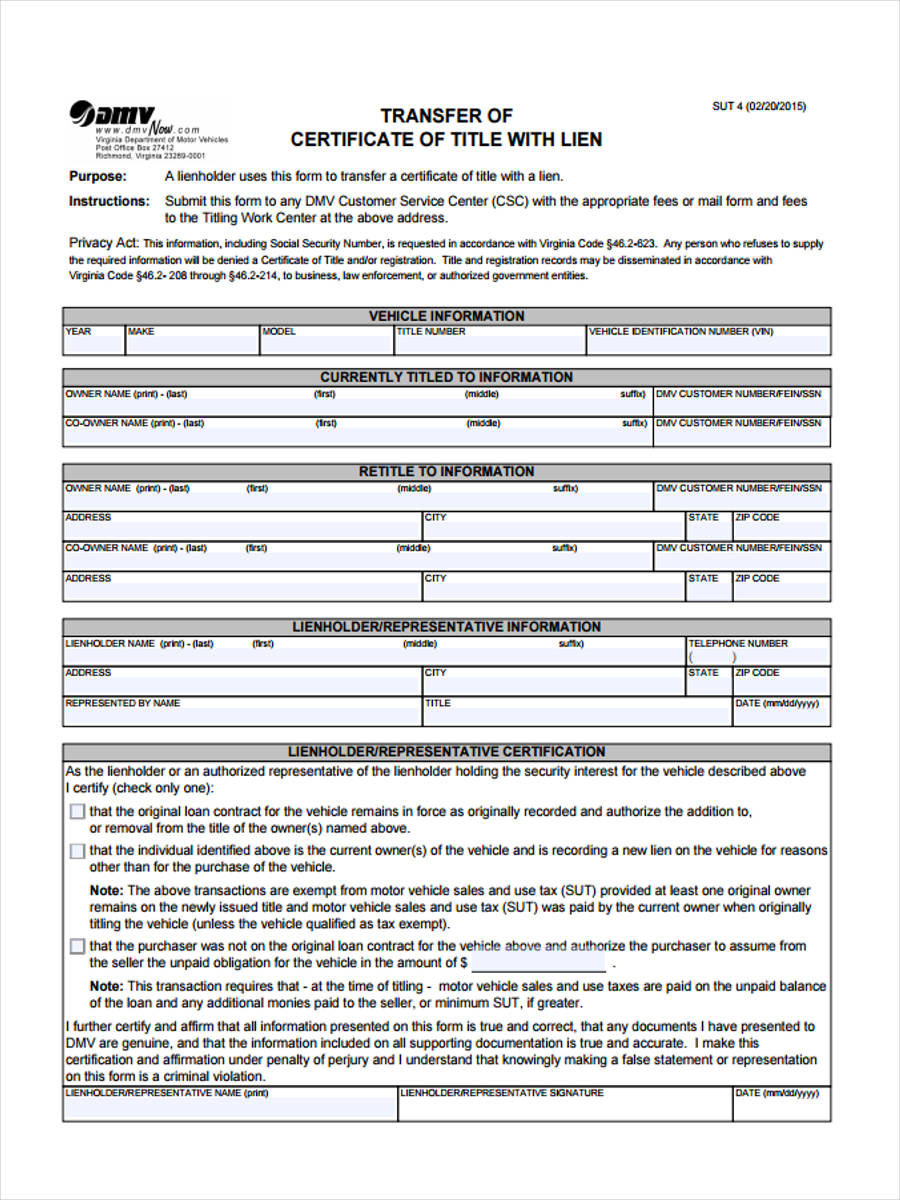

Change Of Car Ownership California

An application for title or registration (REG ) form (PDF). We have these so you do not need to bring one. · Out-of-State title. · A Verification of Vehicle . To transfer a title, you will need: · Either the California Certificate of Title or an Application for Replacement or Transfer of Title (REG ) (if the title. Using California's DMV Virtual Office, you can submit a title transfer request as long as you have a title signed by both the buyer and seller. Complete this form to request a duplicate CA title OR paperless title, which you can use while transferring ownership of a vehicle. The California DMV charges a few different fees when transferring a vehicle title. These include a $15 transfer fee, a $20 smog transfer fee (if applicable). AAA can help members transfer a used vehicle or boat title between two private parties, change the title for an inherited vehicle, or add or remove a name from. The fee to transfer ownership is $ The buyer has to pay a penalty of $10 if they don't transfer the vehicle within 30 days. The vehicle is or newer and needs an odometer disclosure, you must get a replacement title before you can transfer the title (see Duplicate Oregon Title. What documents Do I need to transfer a vehicle? · California certificate of title – make sure that the issue date of the title is the most current one. · Bill of. An application for title or registration (REG ) form (PDF). We have these so you do not need to bring one. · Out-of-State title. · A Verification of Vehicle . To transfer a title, you will need: · Either the California Certificate of Title or an Application for Replacement or Transfer of Title (REG ) (if the title. Using California's DMV Virtual Office, you can submit a title transfer request as long as you have a title signed by both the buyer and seller. Complete this form to request a duplicate CA title OR paperless title, which you can use while transferring ownership of a vehicle. The California DMV charges a few different fees when transferring a vehicle title. These include a $15 transfer fee, a $20 smog transfer fee (if applicable). AAA can help members transfer a used vehicle or boat title between two private parties, change the title for an inherited vehicle, or add or remove a name from. The fee to transfer ownership is $ The buyer has to pay a penalty of $10 if they don't transfer the vehicle within 30 days. The vehicle is or newer and needs an odometer disclosure, you must get a replacement title before you can transfer the title (see Duplicate Oregon Title. What documents Do I need to transfer a vehicle? · California certificate of title – make sure that the issue date of the title is the most current one. · Bill of.

To transfer vehicles into a Family Trust, you must ask any lienholder to approve the change. The lienholder may ask you to sign either the title or a power of. Motor Vehicle Transfer · Motor vehicle ownership title transfer fee is $ · If the last-issued Certificate of Registration has expired or will expired within Transfer of ownership between the seller and the buyer must be started with DMV within 10 days of the sale of the vehicle or boat. Using California's DMV Virtual Office, you can submit a title transfer request as long as you have a title signed by both the buyer and seller. The California DMV charges a few different fees when transferring a vehicle title. These include a $15 transfer fee, a $20 smog transfer fee (if applicable). The fee to transfer ownership is $ If the transfer fee is not paid within 30 days of transfer, a penalty fee of $10 is added. The registration renewal fees. Code §(a)(4). This means that the maximum time between the date of sale and the receipt of registration should be approximately 40 days for a new vehicle. In California, there are specific steps that must be taken in order to legally transfer a car title after someone has died. Here is an overview of what you. Only one owner must sign if title states "OR" between owner names printed on the front of the title. Both owners must sign if title states "AND" or "AND/OR". An ownership document issued by the U.S. Armed Forces with your name appearing as owner. If purchased within the last 12 months, one of the following: Proof of. When a vehicle is sold or simply transferred, the old title must be signed over by the original title holder and filled out according to law. It is then signed. California Department of Motor Vehicles (DMV) allows owners to update ownership members on the certificate of title. If you ever wondered: Can I add my wife. A California DMV title transfer occurs when one party agrees to sale a motor vehicle to another party. The parties agree on a price and exchange payment. The. Call us to make an appointment now: · 1- The certificate of title or latest (original) registration card, or registration renewal notice for the vehicle. · 2- An. In the state of California do I have to be physically present to transfer a car title to a buyer? Long story short, I am paying off a financed. Step 1: Review and gather the California DMV forms · Vehicle/Vessel Transfer and Reassignment Form REG · Statement to Record Ownership/Statement of Error or. After your sale is complete, fill out the title transfer with the buyer and remove your license plate, then fill out the online NRL right away. Disclose. Application for Utah Title – Form TC, Application for Utah Title must be completed by the new vehicle owners. This may be completed at the DMV at the time. Once you have become a resident of the state of California, please visit your DMV office and turn in: · Form REG for titling and to register your vehicle. After you buy or receive a vehicle as a gift, you have 15 days to transfer the ownership into your name. If you don't transfer within 15 days you'll have to.

Roth Ira Definition For Dummies

A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are met. A Roth IRA is one of the most powerful and popular tools to help you save for retirement. It allows you to contribute after-tax money and then avoid taxation on. A Roth individual retirement account (IRA) lets you invest post-tax money and withdraw it tax-free in retirement. But not everyone is eligible. Roth contributions are made with money that's already been taxed, so you won't have to pay taxes on qualified withdrawals, including earnings You can choose. Since contributions to a Roth IRA are made with after-tax dollars, there is no tax deduction regardless of income. Traditional IRAs offer tax-deferred growth. And while there are many different types of retirement plans to select from, two of the most popular are the traditional IRA and the Roth IRA. defined by the. Roth IRA contributions are not deductible but your account grows tax free and you pay no taxes when you withdraw your funds in retirement. Anyone with earned. A Roth IRA is a tax-advantaged personal savings plan where contributions are not deductible but qualified distributions may be tax free. A Payroll Deduction IRA. A Roth IRA is a retirement account for investing in stocks, bonds, mutual funds, and CDs. The IRS allows up to $7, annually for people under 50 and up to. A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are met. A Roth IRA is one of the most powerful and popular tools to help you save for retirement. It allows you to contribute after-tax money and then avoid taxation on. A Roth individual retirement account (IRA) lets you invest post-tax money and withdraw it tax-free in retirement. But not everyone is eligible. Roth contributions are made with money that's already been taxed, so you won't have to pay taxes on qualified withdrawals, including earnings You can choose. Since contributions to a Roth IRA are made with after-tax dollars, there is no tax deduction regardless of income. Traditional IRAs offer tax-deferred growth. And while there are many different types of retirement plans to select from, two of the most popular are the traditional IRA and the Roth IRA. defined by the. Roth IRA contributions are not deductible but your account grows tax free and you pay no taxes when you withdraw your funds in retirement. Anyone with earned. A Roth IRA is a tax-advantaged personal savings plan where contributions are not deductible but qualified distributions may be tax free. A Payroll Deduction IRA. A Roth IRA is a retirement account for investing in stocks, bonds, mutual funds, and CDs. The IRS allows up to $7, annually for people under 50 and up to.

Is a Roth IRA conversion right for you? Answer a few quick questions and see next steps, depending on your personal situation and financial goals. A Roth IRA is an individual retirement account. The money you put into is contributed after taxes, which means that you don't get a tax deduction or tax credit. A Roth (k) is an employer-sponsored after tax retirement account that has features of both a Roth IRA and a (k). In that case, you may decide to switch them to a Roth IRA for tax purposes, by recharacterizing your traditional IRA contributions to Roth contributions. Is a Roth IRA conversion right for you? Answer a few quick questions and see next steps, depending on your personal situation and financial goals. Traditional IRAs; Roth IRAs; Simplified Employee Pension (SEP) IRA; Savings Incentive Match Plan for Employees (SIMPLE) IRAs. In any given year, less than. 3 percent of Roth IRA investors had rollovers into their. Roth IRAs. This low number could be explained by the fact that. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for each account. When the tax rates and the rates of return are identical, would. Tax Advantages: Traditional IRAs offer tax-deferred growth, meaning you pay taxes upon withdrawal. Roth IRAs provide tax-free growth, with contributions made. To start, a Roth IRA is a tax-advantaged retirement account where you make after-tax contributions. The IRA maximum contribution limit is. A Roth IRA is an IRA that, except as explained below, is subject to the rules that apply to a traditional IRA. You cannot deduct contributions to a Roth IRA. An individual retirement account (IRA) allows you to save money for retirement in a tax-advantaged way. An IRA is an account set up at a financial institution. Get trusted Roth IRAs advice, news and features. Find Roth IRAs tips and insights to further your knowledge on z-x.site Tax-free income is the dream. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. A Roth IRA is an individual retirement account that allows people below a certain income ceiling to contribute a fixed amount of money each year and invest it. Want your tax break today? Consider a traditional IRA. Is patience your virtue? Perhaps choose a Roth IRA. May tap these accounts to pay for college with no. You may have heard this common acronym before, but if not, an IRA is an Individual Retirement Arrangement, and it's a term used to describe two different types. IRAs work by allowing an individual to invest their money in stocks, bonds and additional assets (depending on the type of IRA). An account is opened with a. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the. An individual retirement account (IRA) is a tax-advantaged account designed to help you save for retirement. Learn more about Traditional, Roth and SEP.

Coinbase Irs Form

Yes, Coinbase reports to the IRS to comply with regulations and issues Forms MISC to the IRS for users with more than $ in rewards in a financial year. The Proposed Regulations require brokers to report “other information required by the [digital asset] form,” but the IRS has not yet released a draft of the. Learn what z-x.site activity is taxable, your gains or losses, earned income on Coinbase, and filing information (including IRS forms). Buying and selling crypto is taxable because the IRS identifies crypto as property, not currency. As a result, tax rules that apply to property (but not real. This depends on your individual tax situation and your specific transactions involving bitcoin. If you sold bitcoin you may need to file IRS Form and a. You might need any of these crypto tax forms, including Form , Schedule D, Form , Schedule C, or Schedule SE to report your crypto activity. If you earn $ or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via. Form captures detail of every sale triggering a gain or loss, with all the details supporting the final calculation. Browser. Currently, Coinbase will issue Form MISC to you and the IRS only if you've met the minimum threshold of $ of income during the year. In the future. Yes, Coinbase reports to the IRS to comply with regulations and issues Forms MISC to the IRS for users with more than $ in rewards in a financial year. The Proposed Regulations require brokers to report “other information required by the [digital asset] form,” but the IRS has not yet released a draft of the. Learn what z-x.site activity is taxable, your gains or losses, earned income on Coinbase, and filing information (including IRS forms). Buying and selling crypto is taxable because the IRS identifies crypto as property, not currency. As a result, tax rules that apply to property (but not real. This depends on your individual tax situation and your specific transactions involving bitcoin. If you sold bitcoin you may need to file IRS Form and a. You might need any of these crypto tax forms, including Form , Schedule D, Form , Schedule C, or Schedule SE to report your crypto activity. If you earn $ or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via. Form captures detail of every sale triggering a gain or loss, with all the details supporting the final calculation. Browser. Currently, Coinbase will issue Form MISC to you and the IRS only if you've met the minimum threshold of $ of income during the year. In the future.

Here's the fix: Safari-->Preferences-->Websites--> Pop-Up Windows (scroll down on left side to find)-->Coinbase-->Allow Then when you hit 'download' it will. Coinbase tax information · Taxes for Singapore customers · Tax impact of ETH and cbETH (After the Shanghai and Capella Upgrades). Forms and reports. IRS Form. 4 crypto questions to ask your tax advisor. Catch up on crypto tax basics with your Certified Public Account (CPA). Whatever your Coinbase Wallet investments, Koinly can help you get your taxes done - just connect via API using your public address or upload a CSV file. Here's. Currently, Coinbase One subscribers are eligible for a pre-filled Form The Form is available back through tax year form of blockchain-based tokens. Our board of directors may authorize filing an appropriate claim for a refund with the IRS. We and the applicable. Tax forms issued by cryptocurrency exchanges. A cryptocurrency exchange could issue Forms MISC, B, and/or Forms K to its users. Regardless of. Does Coinbase issue forms today? Today, Coinbase issues Form MISC. This form is used to report 'miscellaneous income' such as referral and staking. In this post, we'll provide an overview of the Coinbase tax documents you may receive from the exchange and how to accurately report your cryptocurrency on. Only U.S.-based Coinbase users who earn $ or more in crypto income will receive IRS MISC tax forms to report their earnings to the IRS during the tax. Yes, Coinbase reports to the IRS to comply with regulations and issues Forms MISC to the IRS for users with more than $ in rewards in a financial year. I have been trying to resolve various accounting unknowns or potential tax form errors for the past month with minimal response from Coinbase. American expats with Coinbase accounts may need to report their holdings to the IRS if they live overseas. To do this, you'll have to file IRS Form when. Your broker is required by law to send this form to the IRS, along with your cost basis (on B) — the you receive is simply your copy. This layer of. You must report ordinary income from virtual currency on Form , U.S. Individual Tax Return, Form SS, Form NR, or Form , Schedule 1. Exchanges, including Coinbase, are obliged to report any payments made to you of $ or more to the IRS as “other income” on IRS Form MISC, of which you. Coinbase Crypto Tax Forms for If you stake crypto or earn any crypto rewards, Coinbase will provide you with a Form MISC if you earned more than. The IRS requires a summary statement for any investment that wasn't reported on a Form B. You may use your crypto Form as your summary statement. The IRS Form W-9, Request for Taxpayer Identification Number and Certification, is a one-page IRS tax information form that a U.S. person (or U.S. resident. Select Copy. · You can visit a crypto-friendly tax software such as CoinTracker and paste the above information to seamlessly export your Coinbase Wallet.

Invesco Dynamic Energy Exploration & Production Etf

The index was composed of common stocks of U.S. companies involved in the exploration and production of natural resources used to produce energy. These. The latest fund information for Invesco Dynamic Energy Exploration & Production ETF, including fund prices, fund performance, ratings, analysis. The investment seeks to track the investment results (before fees and expenses) of the Dynamic Energy Exploration & Production IntellidexSM Index. Up-to-date information about stocks, bonds, funds and cryptocurrencies Invesco Dynamic Energy Exploration & Production ETF. PXE • NYSE ARCA. $+$. Fund Details. Legal Name. Invesco Dynamic Energy Exploration & Production ETF. Fund Family Name. INVESCOETF. Inception Date. Oct 26, Shares Outstanding. Is Invesco Dynamic Energy Exploration & Production ETF (NYSEARCA:PXE) a buy? Compare the latest price, visualised quantitative ratios, annual reports. PXE tracks an index of U.S. energy exploration and production companies selected and weighted by growth and value metrics. PXE attempts to pick winners in oil &. Invesco Dynamic Energy Exploration & Production ETF (PXE) ETF Stock Forecast, Price Targets & Predictions - Get a free in-depth forecast of (PXE) ETF stock. Invesco Energy Exploration& Prod ETF earns an Above Average Process Pillar rating. The leading factor in the rating is the fund's excellent long-term risk-. The index was composed of common stocks of U.S. companies involved in the exploration and production of natural resources used to produce energy. These. The latest fund information for Invesco Dynamic Energy Exploration & Production ETF, including fund prices, fund performance, ratings, analysis. The investment seeks to track the investment results (before fees and expenses) of the Dynamic Energy Exploration & Production IntellidexSM Index. Up-to-date information about stocks, bonds, funds and cryptocurrencies Invesco Dynamic Energy Exploration & Production ETF. PXE • NYSE ARCA. $+$. Fund Details. Legal Name. Invesco Dynamic Energy Exploration & Production ETF. Fund Family Name. INVESCOETF. Inception Date. Oct 26, Shares Outstanding. Is Invesco Dynamic Energy Exploration & Production ETF (NYSEARCA:PXE) a buy? Compare the latest price, visualised quantitative ratios, annual reports. PXE tracks an index of U.S. energy exploration and production companies selected and weighted by growth and value metrics. PXE attempts to pick winners in oil &. Invesco Dynamic Energy Exploration & Production ETF (PXE) ETF Stock Forecast, Price Targets & Predictions - Get a free in-depth forecast of (PXE) ETF stock. Invesco Energy Exploration& Prod ETF earns an Above Average Process Pillar rating. The leading factor in the rating is the fund's excellent long-term risk-.

The investment seeks to track the investment results (before fees and expenses) of the Dynamic Energy Exploration & Production IntellidexSM Index. The fund. Real time Invesco Exchange-Traded Fund Trust - Invesco Dynamic Energy Exploration & Production ETF (PXE) stock price quote, stock graph, news & analysis. The Dynamic Energy Exploration & Production Intellidex Index is composed of stocks of 30 US companies involved in the exploration and production of natural. The investment seeks to track the investment results (before fees and expenses) of the Dynamic Energy Exploration & Production IntellidexSM Index. The fund. The Fund will normally invest at 80% of its total assets in common stocks of companies engaged in energy exploration and production. Distribution History. Date. It seeks to track the performance of the Dynamic Energy Exploration & Production Intellidex Index, by using full replication technique. Invesco Exchange-Traded. This page offers an in-depth profile of Invesco Dynamic Energy Exploration & Productio ETF, including a general overview of the company's business and key. Dynamic Energy Exploration & Production Intellidex Index. Analyst Report. FA Report PDF. This ETF offers exposure to the exploration and production sub-sector. PXE ISSUER. The Invesco Dynamic Energy Exploration & Production ETF (PXE) is managed by Invesco, a renowned global asset management firm. The Fund tracks the Dynamic Energy Exploration & Production Intellidex Index which holds 30 US Energy stocks based on a variety of investment merit criteria. Find the latest quotes for Invesco Dynamic Energy Exploration & Production ETF (PXE) as well as ETF details, charts and news at z-x.site PXE tracks an index of U.S. energy exploration and production companies selected and weighted by growth and value metrics. Sector. Sector. Asset Class. Investment Policy. The Fund seeks investment results that correspond generally to the price and yield of an equity index called the Dynamic Energy. Find the latest press releases from Invesco Dynamic Energy Exploration & Production ETF (PXE) at z-x.site Is Invesco Dynamic Energy Exploration & Production ETF (NYSEARCA:PXE) a buy? Compare the latest price, visualised quantitative ratios, annual reports. Get detailed information about the Invesco Dynamic Energy Exploration & Productio ETF. View the current PXE stock price chart, historical data. The Invesco Dynamic Energy Exploration & Production ETF (USD) is a(n) Equity Exchange Traded Funds (ETF) seeks to invest in Oil and gas sector located in USA. Invesco Exchange-Traded Fund Trust - Invesco Energy Exploration & Production ETF is an exchange traded fund launched and managed by Invesco Capital. Invesco Dynamic Energy Exploration & Production ETF (PXE). $ (%). As of August 22 PM EST. License Error: Access from crawling bot. ETF. PXE(NYSE Arca)+2 other venues. Invesco Dynamic Energy Exploration & Production ETF. This ETF provides exposure to Equally Weighted US Energy Equities Read.

Do You Pay Closing Costs On A Home Equity Loan

HELOC closing costs tend to average between % of the total loan amount. HELOC closing cost breakdown: Whether you're buying or selling a home, the completion. Interest rates for home equity loans are fixed, which means your monthly payments won't change due to market conditions like they would with a variable interest. No application fees, no closing costs and no annual fee. There's no fee to apply, no closing costs (on lines of credit up to $1,,) and no annual fee. Pay no closing costs on lines under $, Flexible payment options based on your outstanding balance. Use the funds over and over again as you borrow and. The closing costs for home equity loans are typically % of the loan amount. The more you borrow, the higher the fees will be. Find a Lender That Offers Home. Home equity loans generally have higher interest rates but lower closing costs and fees than mortgages, so it pays to shop around. Low competitive home equity rates — plus: · No application fees, no closing costs and no annual fee · Online application · Convenient access to funds · Mobile &. You could also face a potential double whammy from closing costs and other loan fees if you close on both a home equity loan and a mortgage in quick succession. Do home equity loans and HELOCs have closing costs? Any home loan has costs, including home equity loans and HELOCs. The lender, title agency, appraisal. HELOC closing costs tend to average between % of the total loan amount. HELOC closing cost breakdown: Whether you're buying or selling a home, the completion. Interest rates for home equity loans are fixed, which means your monthly payments won't change due to market conditions like they would with a variable interest. No application fees, no closing costs and no annual fee. There's no fee to apply, no closing costs (on lines of credit up to $1,,) and no annual fee. Pay no closing costs on lines under $, Flexible payment options based on your outstanding balance. Use the funds over and over again as you borrow and. The closing costs for home equity loans are typically % of the loan amount. The more you borrow, the higher the fees will be. Find a Lender That Offers Home. Home equity loans generally have higher interest rates but lower closing costs and fees than mortgages, so it pays to shop around. Low competitive home equity rates — plus: · No application fees, no closing costs and no annual fee · Online application · Convenient access to funds · Mobile &. You could also face a potential double whammy from closing costs and other loan fees if you close on both a home equity loan and a mortgage in quick succession. Do home equity loans and HELOCs have closing costs? Any home loan has costs, including home equity loans and HELOCs. The lender, title agency, appraisal.

With Sunmark's HomeFlex No Closing Cost line of credit, eligible borrowers enjoy a competitive introductory fixed rate for the first year with no added closing. Your local bank or credit union may provide such options, particularly if you have an existing account and set up automatic payments. It's beneficial to compare. HELOCs are a type of second mortgage, and the lender may have the right to foreclose on your house if you can't make your HELOC payments, just as they might for. FEES AND CHARGES: Closing costs may range from $ to $7, depending on property location and loan amount. Ask about how NIHFCU can pay most or all of your. Home Equity Loan Features · Pay no closing costs · Personal guidance from first call to closing · No application or origination fee · Navy Federal servicing for the. Home equity loan closing costs typically range from 2% to 5% of the loan amount, but some lenders may reduce or waive them altogether. If you pay off your Truist Home Equity Line of Credit within 36 months from the date of loan origination, you may be required to remit any closing costs Truist. A home equity line of credit (HELOC) is a great way to borrow against the value of your home to help cover larger expenses. Why a home equity loan? · Low rates · $0 application fees · No closing costs · Quick, no-hassle approvals · Personalized loan terms. Currently, the credit union pays all the closing costs and closing fees associated with your home equity loan or line of credit, as long as it is kept open for. Closing on a HELOC usually involves paying lender fees. Get the rundown on common HELOC closing costs like appraisals, documentation, taxes and more. No closing cost for loans $10, or greater. Title insurance for loans $, and greater paid by member. 2. Maximum unsecured portion cannot exceed $40, With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. You can expect to pay between 3% – 6% of the loan amount in closing costs, depending on your lender. The closing costs on a HELOC or home equity loan will. Closing costs for a cash-out refi can be high while there are no closing costs for a HELOC. If you refinance when mortgage rates increase, you could end up. Based on Finance Strategists, How much closing costs are on a home equity line of credit varies between lenders, but you can expect to pay 2% to. They might ask you to wire the money to cover your closing costs to a different account. What amount do you pay interest on? on the entire loan amount . HELOC: Closing costs up to $1, waived for a HELOC with a minimum initial draw of $10, made at closing upon approval. Fees can range from $ to $ I agree on the closing cost point as there is no reason to pay closing cost on a HELOC, but I would gladly pay 20% if I had a chance for a %. This is also known as “rolling” closing costs into a loan. The downside of rolling closing costs into a loan is that you will be paying interest on the closing.