z-x.site News

News

Make Your Money Work For You

Business And Brands Awareness Strategist · 15 Ways To Put Your Money To Work That You Probably Were Not Taught In School · 1. Create A Precise. Make Your Money Work for You. Protect What You Have. Section 4: Make a Plan. Developing a Game Plan. Set Goals Aligned with Your Values. Spend and Save. Buy Power of Passive Income: Make Your Money Work for You by Nightingale-Conant and The Staff of Entrepreneur Media in bulk from Porchlight Book Company. INPRS offers members several funds to choose from and daily valuation of investments. To learn more about investing and what type of investor you are, view the. Have you ever heard the saying, “Put your money to work for you”? It's often used to encourage people to establish savings or invest their money to become. It pays to pay yourself first: Set up or add to your emergency fund, start setting aside money for your next vacation or a start a down payment fund for a car. You'll usually earn more interest if you move your money from a regular savings account into fixed rate savings (also called Term deposits). We all want to grow our money and make it go further to achieve our financial goals. If you want to make your money work for you, then check out our guides. By selling your skills. Know yourself as what you are good in. Every person is unique. Cash on it. Use that skill to learn technologies through. Business And Brands Awareness Strategist · 15 Ways To Put Your Money To Work That You Probably Were Not Taught In School · 1. Create A Precise. Make Your Money Work for You. Protect What You Have. Section 4: Make a Plan. Developing a Game Plan. Set Goals Aligned with Your Values. Spend and Save. Buy Power of Passive Income: Make Your Money Work for You by Nightingale-Conant and The Staff of Entrepreneur Media in bulk from Porchlight Book Company. INPRS offers members several funds to choose from and daily valuation of investments. To learn more about investing and what type of investor you are, view the. Have you ever heard the saying, “Put your money to work for you”? It's often used to encourage people to establish savings or invest their money to become. It pays to pay yourself first: Set up or add to your emergency fund, start setting aside money for your next vacation or a start a down payment fund for a car. You'll usually earn more interest if you move your money from a regular savings account into fixed rate savings (also called Term deposits). We all want to grow our money and make it go further to achieve our financial goals. If you want to make your money work for you, then check out our guides. By selling your skills. Know yourself as what you are good in. Every person is unique. Cash on it. Use that skill to learn technologies through.

We all want to grow our money and make it go further to achieve our financial goals. If you want to make your money work for you, then check out our guides. A GUIDE TO INVESTING. Page 2. Page 3. SECURITIES COMMISSION OF THE BAHAMAS | MAKING YOUR MONEY WORK FOR YOU 3. In fact, you invest every day. Every time you. Utilize retirement accounts Don't sleep on opportunities to invest in a (k) or Roth IRA. A (k) is great because you're contributing pre-tax money into. Make your money work for you! Stretch your paycheck to cover your bills and expenses and still have money left for your savings and retirement accounts. Use. 10 Smartest Ways To Make Your Money Work for You, According to Experts · Open a High-Yield Savings Account · Create Specific Financial Goals · Automate Your. Now that you have a steady income — whether from a job, your business, or freelancing — let's talk about budgeting. This means planning how you. Boost your income · Flog on eBay for best prices · Sell on Vinted with no fees · Sell for free on Facebook · Get quick cash for old CDs, games & more · Flog tech '. Make Your Money Work For You: How to Grow Your Investment Dollars: CHEE, KEON: Books - z-x.site We've partnered with Channel 5 to bring you a six-part content series where Nick Knowles and our Customer Care Specialist, Janet, cover a range of money topics. Learn how to invest your money in the simplest possible way! Whether you are an investment veteran or wondering how to get started, you will find sensible. The following 6-step guide will help you find out how to make your money work for you. Use Budgeting to Control Your Finances. A GUIDE TO INVESTING. Page 2. Page 3. SECURITIES COMMISSION OF THE BAHAMAS | MAKING YOUR MONEY WORK FOR YOU 3. In fact, you invest every day. Every time you. There are several ways to put your money to work for you! Start Saving Early. The sooner you put your money to work, the more time it has to grow. You'll learn how to save your money to make it work for you, and how to protect it so it will be there when you need it for retirement. It explains how you. Investment accounts: If you have a lot of disposable cash, putting it into a savings account with a high APY isn't the best. Instead, you may be better off. This list of ways to make money with no money at all can really help to get you on the right track to growing a more secure future. The Power of Compound Interest: How to Make Your Money Work for You Imagine growing your money not just by the initial interest rate but also by the interest. Your best bet, then, is to make sure that your money works for you. That means investing your savings in assets that will grow. How can I make my money work for me? Welcome to 'Making your money work for you'. Well, we reckon that learning about money and personal finance are really. How To Make Your Money Work For You · taking advantage of reward credit cards · investing in annuities · acquiring whole life insurance policies · invest in.

How Does Index Fund Investing Work

Index funds are simple, low-cost ways to gain exposure to markets. They're most commonly available as mutual funds and exchange traded funds (ETFs). Index investing is one of the most common forms of passive fund management. Instead of a fund portfolio manager actively picking stocks, index fund managers. Index investing allows you to put money in the largest U.S. companies with low fees and minimal risk. Select breaks down how they work. Index investing is a passive investment method achieved by investing in an index fund. An index fund seeks to generate returns from the broader market. Index investing allows you to put money in the largest U.S. companies with low fees and minimal risk. Select breaks down how they work. Index funds tend to offer significant cost savings over the long run due to their passive investment strategy and typically have lower expense ratios compared. What Are Index Funds, and How Do They Work? Index funds are pooled investments that passively aim to replicate the returns of market indexes. What are Mutual. How do index funds work? Index funds work by holding all or many of the securities within the benchmark index. With smaller indexes like the S&P , the fund. The fund pools money from investors, and the fund manager uses the money to try and replicate the benchmark index. There are funds for all sorts of market. Index funds are simple, low-cost ways to gain exposure to markets. They're most commonly available as mutual funds and exchange traded funds (ETFs). Index investing is one of the most common forms of passive fund management. Instead of a fund portfolio manager actively picking stocks, index fund managers. Index investing allows you to put money in the largest U.S. companies with low fees and minimal risk. Select breaks down how they work. Index investing is a passive investment method achieved by investing in an index fund. An index fund seeks to generate returns from the broader market. Index investing allows you to put money in the largest U.S. companies with low fees and minimal risk. Select breaks down how they work. Index funds tend to offer significant cost savings over the long run due to their passive investment strategy and typically have lower expense ratios compared. What Are Index Funds, and How Do They Work? Index funds are pooled investments that passively aim to replicate the returns of market indexes. What are Mutual. How do index funds work? Index funds work by holding all or many of the securities within the benchmark index. With smaller indexes like the S&P , the fund. The fund pools money from investors, and the fund manager uses the money to try and replicate the benchmark index. There are funds for all sorts of market.

How does an index fund work? An index fund is a diversified equity fund with a difference, i.e., a fund manager has absolutely no say in the stock selection. Since Index Funds track a market index, the returns are approximately similar to those offered by the index. Hence, investors who prefer predictable returns and. How Does an Index Fund Work? An index fund tracks the performance of a specific market index. It invests in the same securities as the underlying index to. A mutual fund uses public money from investors to maintain a portfolio of stocks, bonds or other market securities. Some mutual funds track an index, but they. Index funds make money by earning a return from the stocks or bonds they hold in their portfolio. They also pay dividends, which are. An index fund is an investment fund – either a mutual fund or an exchange-traded fund (ETF) – that is based on a preset basket of stocks, or index. It's a mutual fund that tracks a specific market index. The goal: mirror the index's holdings, activity, and return. Use our tools to find the right index fund. Vanguard index funds stand above the rest. An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or "index,". Since Index Funds track a market index, the returns are approximately similar to those offered by the index. Hence, investors who prefer predictable returns and. Index funds are a type of mutual fund portfolio, where your money gets pooled together with other investors in stocks, bonds and more. Theyre passively managed. Index funds are very tax-efficient. Most indexes have very low turnover ratios compared to actively managed funds. In other words, fund managers aren't buying. Index funds work by investing in the same securities that make up the index they are tracking, in the same proportion. For instance, if an index fund tracks the. How do index funds work? Since index funds are a type of passive mutual fund, when you purchase shares in an index fund, you're simply adding your money into. Equity index funds would include groups of stocks with similar characteristics such as the size, value, profitability and/or geographic location of the. Equity index funds would include groups of stocks with similar characteristics such as the size, value, profitability and/or geographic location of the. Index funds were invented by John Bogle, who wrote his senior thesis at Princeton in on them. Later Bogle started Vanguard, now one of the largest asset. Now, indexed ETFs have further expanded the popularity and flexibility of index investing. Vanguard, the world's largest index fund company, now has over $5. First, there are open-end index mutual funds. You give your money to the mutual fund company, it buys stocks from the market in question and gives you a share. An index fund will attempt to achieve its investment objective primarily by investing in the securities (stocks or bonds) of companies that are included in a. How does an index fund work? An index fund is a diversified equity fund with a difference, i.e., a fund manager has absolutely no say in the stock selection.

Enter Phone Number For Spam

“”, “”, and “” numbers are another way for telemarketers to obtain your phone number. When you call these numbers, your phone number may be captured. Register your phone number to report stop or block unwanted, annoying,telemarketing, spam calls, robocalls to the FTC. Please enter only numbers in Phone. Adding Your Number to the Registry Go to z-x.site or call (TTY: ) from the phone you want to register. It's free. To report numbers that you believe should be listed as spam, or incorrectly labeled as such, please visit z-x.site Nomorobo. If you are a Verizon. Allow a number. Add important numbers to your Allow list to prevent them from being blocked. In the Scam Shield app, select the Activity tab. Select the name of. It is a free service where consumers can securely register their home, mobile or fax numbers for free to reduce unsolicited telemarketing calls. How do I add a number to spam list? If you receive a spam call that was not marked as spam, you can add the number to your spam list. Open the Phone app. A common trick is to "Spoof" any random phone number in an autodialer and call thousands of users hoping to reach some of them. Type the phone number into the Number field. Select whether you're reporting the number as 'Spam' or 'Not spam'. If Spam, select a category (e.g., Scammer. “”, “”, and “” numbers are another way for telemarketers to obtain your phone number. When you call these numbers, your phone number may be captured. Register your phone number to report stop or block unwanted, annoying,telemarketing, spam calls, robocalls to the FTC. Please enter only numbers in Phone. Adding Your Number to the Registry Go to z-x.site or call (TTY: ) from the phone you want to register. It's free. To report numbers that you believe should be listed as spam, or incorrectly labeled as such, please visit z-x.site Nomorobo. If you are a Verizon. Allow a number. Add important numbers to your Allow list to prevent them from being blocked. In the Scam Shield app, select the Activity tab. Select the name of. It is a free service where consumers can securely register their home, mobile or fax numbers for free to reduce unsolicited telemarketing calls. How do I add a number to spam list? If you receive a spam call that was not marked as spam, you can add the number to your spam list. Open the Phone app. A common trick is to "Spoof" any random phone number in an autodialer and call thousands of users hoping to reach some of them. Type the phone number into the Number field. Select whether you're reporting the number as 'Spam' or 'Not spam'. If Spam, select a category (e.g., Scammer.

How to block scam calls · Block Spam Calls. · Get even more of what you love from T-Mobile. · Check out customer benefits. · Discover our better network with. Consumers can also add their phone numbers to the National Do Not Call Registry at no cost. Keep in mind, as mentioned earlier, spam callers aren't known for. 1. Use an AI-powered spam call blocker · 2. Block individual spam numbers · 3. Use spam blocking tools from your phone carrier · 4. Silence unknown callers · 5. Add. You can add your number to the Do Not Call Registry online and file spam telemarketer call complaints through z-x.site Unfortunately, this will only limit. Find out how to file complaints about the sales and scam calls and texts you receive. And learn how you may be able to reduce the number of unwanted calls and. Check phone numbers closely. Scam artists spoof calls to make them appear to be from a local telephone number. · Hang up. If you answer a call that seems. It can automatically block unwanted calls based on known spammers, as well as numbers you manually add. You can look up specific names and phone numbers to get. Spam Calls: The phone number will be marked as Spam and blocked and In the search box, enter the name, extension, or phone number you are looking for. Call toll free () to add your numbers or join by email at z-x.site What If Telemarketers Keep Calling? Stop telemarketers who keep calling. It is a free service where consumers can securely register their home, mobile or fax numbers for free to reduce unsolicited telemarketing calls. Truecaller now helps you identify spam and scam phone numbers by just a simple phone number search. Enter the number in the search bar and get the results. your mobile phone number to any customer website. You should be able to opt ▫ Hiya: Stops mobile spam and includes caller ID and blocking features. Changing Your Extension Settings. Mouse over Configure and click Manage Users and Extensions. · Changing Your Phone Number Settings · Note: · More guidance from. Unless it's essential or mandatory, avoid giving your number out to help reduce the number of unwanted texts and calls. Don't post your cell phone number. 1. Use an AI-powered spam call blocker · 2. Block individual spam numbers · 3. Use spam blocking tools from your phone carrier · 4. Silence unknown callers · 5. Add. You can add your number to the Do Not Call Registry online and file spam telemarketer call complaints through z-x.site Unfortunately, this will only limit. This is obviously pretty odd, and I would brush it off as spam or a prank but the fact that the same numbers were registered as being in the same call multiple. You can add or remove phone numbers, country codes, or other patterns to the call block list. Ensure that the numbers and patterns are in E format. Block. Use Smart Call · Tap Block number to add the number to your blocked call list. · Tap Report Number if you feel the call is fraudulent, and then select a category. It can automatically block unwanted calls based on known spammers, as well as numbers you manually add. You can look up specific names and phone numbers to get.

Sh Short Etf

Is SH a leveraged ETF. Yes, SH is a Inverse (-1) ETF: This means that SH will try to match the performance of S&P Index, but with 1x the returns. ProShares Short S&P ETF (SH) key stats comparison: compare with other stocks by metrics: valuation, growth, profitability, momentum, EPS revisions. This ETF offers inverse exposure to an index comprised of large cap U.S. equities, making it a potentially attractive option for investors looking to bet. The ProShares Short S&P (USD) is a(n) Equity Exchange Traded Funds (ETF) seeks to invest in Large Cap sector located in USA. The ProShares fund's base. FUND DESCRIPTION: The ProShares Short S&P Fund is an exchange-traded index fund that is a separate investment portfolio of the ProShares Trust. SH ETF in-depth analysis and real-time data such as the investment strategy, characteristics, ETF Facts, price, exposure, AuM, Expense Ratio, and more. Inverse/Short ETFs seek to provide the opposite return of an index for a single day. This creates an effect similar to shorting an asset class. ProShares Short S&P (SH) Find here information about the ProShares Short S&P ETF (SH). Assess the SH stock price quote today as well as the premarket. The Fund seeks daily investment results, before fees and expenses, that correspond to the inverse (opposite) of the daily performance of the S&P Index. Is SH a leveraged ETF. Yes, SH is a Inverse (-1) ETF: This means that SH will try to match the performance of S&P Index, but with 1x the returns. ProShares Short S&P ETF (SH) key stats comparison: compare with other stocks by metrics: valuation, growth, profitability, momentum, EPS revisions. This ETF offers inverse exposure to an index comprised of large cap U.S. equities, making it a potentially attractive option for investors looking to bet. The ProShares Short S&P (USD) is a(n) Equity Exchange Traded Funds (ETF) seeks to invest in Large Cap sector located in USA. The ProShares fund's base. FUND DESCRIPTION: The ProShares Short S&P Fund is an exchange-traded index fund that is a separate investment portfolio of the ProShares Trust. SH ETF in-depth analysis and real-time data such as the investment strategy, characteristics, ETF Facts, price, exposure, AuM, Expense Ratio, and more. Inverse/Short ETFs seek to provide the opposite return of an index for a single day. This creates an effect similar to shorting an asset class. ProShares Short S&P (SH) Find here information about the ProShares Short S&P ETF (SH). Assess the SH stock price quote today as well as the premarket. The Fund seeks daily investment results, before fees and expenses, that correspond to the inverse (opposite) of the daily performance of the S&P Index.

Performance charts for ProShares Short S&P (SH - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. An easy way to get ProShares Short S&P real-time prices. View live SH stock fund chart, financials, and market news. For example, the ProShares Short S&P (SH) is an inverse ETF that seeks to provide daily investment results, before fees and expenses, corresponding to. Top 10 Holdings in SH Due to the effects of compounding and possible correlation errors, leveraged and inverse ETFs may experience greater losses than one. SH provides inverse exposure to a market cap-weighted index of large- and mid-cap US firms selected by the S&P Index Committee. You are looking for "inversed" etfs. SH ProShares Short S&P [‑1x]. PSQ ProShares Short QQQ [‑1x]. ProShares Short S&P (SH) provides inverse exposure to large and midsize companies in the S&P It had an expense ratio of % and about $ billion. It holds SH's shares valued at K. ETF Description. ProShares Short S&P SH provides inverse exposure to a market cap-weighted index of large- and. ProShares Short S&P seeks daily investment results equivalent to the opposite (inverse) of the S&P, or '-1' of the underlying target in a single day's. Short Bitcoin Strategy ETF, Crypto-Linked, -1x, Crypto-Linked, $ SH, Short S&P, Broad Market, -1x, Equity, $, S&P ® (SPX), Broad Market. Short S&P -1X ETF stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Find the latest quotes for ProShares Short S&P (SH) as well as ETF details, charts and news at z-x.site The ProShares Short S&P (SH) is an exchange-traded fund that is based on the S&P index. The fund provides inverse exposure to a market cap-weighted. ETF information about ProShares Short S&P, symbol SH, and other ETFs, from ETF Channel. SH ETF in-depth analysis and real-time data such as the investment strategy, characteristics, ETF Facts, price, exposure, AuM, Expense Ratio, and more. What is SH? SH is a US Equities ETF. ProShares Short S&P seeks daily investment results before fees and expenses that correspond to the inverse (opposite) of. Zacks ETF Categories» Trading Tools» Inverse Equity ETFs. Enter Symbol. ETF Fund Summary for SH. PROSHARES SHORT S&P The ProShares Short S&P Get the latest ProShares Short S&P ETF (SH) real-time quote, historical performance, charts, and other financial information to help you make more. SH Fund Profile. ProShares Trust - ProShares Short S&P is an exchange traded fund launched and managed by ProShare Advisors LLC. The fund. ProShares Short S&P (SH) - Long Setup Looking z-x.site inverse ETF is looking bullish, and trend has shifted to the upside. In other words, the S&P itself.

Medicare And Life Alert

Featured products · Lively® - Lively Mobile2 All-in-One Medical Alert - Black. Model: R5-RTL-BLK-8IN. SKU: Lively® - Lively Mobile2 All-in-One Medical. America's #1 Rated Medical Alert Provider. The Bay Alarm Medical In-Home Medical Alert ($ per month) is a moderately priced, no-contract personal emergency. What Medicare Coverage Options are Available for Life Alert? In most cases, Original Medicare plans do not provide coverage for medical alert systems. Medicare. In emergency, get emergency room services coverage as part of your health insurance. Cover costs at z-x.site for sudden illness & injury. Medical Alerts starting at $/mo. LifeStation® gives you & your family peace of mind at the push of a button with the #1 rated monitoring center. Top Rated Medical Alert Company. Our Medical Alert Systems Provide 24/7 Emergency Care. From $/Month. No Startup Costs Or Long-Term Contracts. Medical Alerts starting at $/mo. LifeStation® gives you & your family peace of mind at the push of a button with the #1 rated monitoring center. AARP members save 15% on Lifeline Medical Alert Service and get free shipping and activation. Learn more about this service now. If you or a loved one needs a medical alert system, your device may be covered by a private insurer or Medicare Part C. But in most cases, Medicare doesn't. Featured products · Lively® - Lively Mobile2 All-in-One Medical Alert - Black. Model: R5-RTL-BLK-8IN. SKU: Lively® - Lively Mobile2 All-in-One Medical. America's #1 Rated Medical Alert Provider. The Bay Alarm Medical In-Home Medical Alert ($ per month) is a moderately priced, no-contract personal emergency. What Medicare Coverage Options are Available for Life Alert? In most cases, Original Medicare plans do not provide coverage for medical alert systems. Medicare. In emergency, get emergency room services coverage as part of your health insurance. Cover costs at z-x.site for sudden illness & injury. Medical Alerts starting at $/mo. LifeStation® gives you & your family peace of mind at the push of a button with the #1 rated monitoring center. Top Rated Medical Alert Company. Our Medical Alert Systems Provide 24/7 Emergency Care. From $/Month. No Startup Costs Or Long-Term Contracts. Medical Alerts starting at $/mo. LifeStation® gives you & your family peace of mind at the push of a button with the #1 rated monitoring center. AARP members save 15% on Lifeline Medical Alert Service and get free shipping and activation. Learn more about this service now. If you or a loved one needs a medical alert system, your device may be covered by a private insurer or Medicare Part C. But in most cases, Medicare doesn't.

Whether at home or on the go, Medical Alert allows you to take peace of mind with you wherever you go. With the simple press of a button, you can call for help. Currently, we are not able to accept Medicare, Medicaid, or any insurance as payment. We encourage our members to contact their health insurance provider to see. In our rating of the Best Medical Alert Systems, monthly monitoring fees range from $ with Life Protect 24/7 to $ with MobileHelp. As a UnitedHealthcare Medicare Advantage member, you may be eligible to receive the Lifeline medical alert service. Lifeline is an easy-to-use medical alert. It is very easy to unplug and re-install. Simply notify Medical Care Alert Customer Service at of your current location. Information can be changed. Our medical alert devices for seniors provide you with 24/7 Emergency Response Centers in USA, Automatic Fall Detection, Text Messaging to Family and/or. We have had multiple patients press their medical alert pendant after their heart stopped beating for a short time, and because this remote technology enabled. Our award-winning in-home alert devices provide around the clock protection using the most advanced features available. Medical Guardian MGMini – Medical Alert Necklace Systems for Seniors- Fast, Reliable Water-Resistant Panic Button, 4G GPS Tracker with 24/7 Emergency. Telephone alert systems are also known as emergency medical alert button systems (e.g., AlertOne, Lifeline, etc.), Please check benefit plan descriptions. + lives saved! Life Alert saves a life from a catastrophe every 11 minutes. 24/7 help for fall, medical, shower, out of home emergencies. Medical alert systems for every lifestyle. Get protection while you're at home, or wherever you go. Add features to your medical alert system like Fall. Medicare Part A covers inpatient care in hospitals or nursing facilities, hospice care and limited home health care. Medicare Part B covers medically necessary. The official U.S. government website for Medicare, a health insurance program for people age 65 or older and younger people with disabilities. To receive this GEHA discount (free activation plus a 10% discount on your monthly billing), call and request a free Life Alert brochure. A. LifeStation's In Home Medical Alert gives you the independence and peace of mind that comes with the leading senior alert device in America! What Medical Alert Providers Partner with the VA? The VA partners with two companies, LifeLife and MedEquip Alert, to provide medical alert systems to senior. Nevada Emergency Medical Alerts Systems that provide emergency medical alerts systems for individuals who require routine medical services. With a Lifeline medical alert system you have quick access to the help you need 24/7, days a year, whether at home or on the go, ensuring peace of mind for. Features · State-of-the-art, voice-activated medical alert and communication system · Real-time fall-response; environmental monitoring · Coverage at home or on.

Best State 529 Savings Plan

The Vanguard College Savings Plan is a Nevada Trust administered by the office of the Nevada State Treasurer. *The availability of tax or other benefits may. NY Achieving a Better Life Experience (ABLE). Comptroller DiNapoli administers the Direct Plan component of the college savings program with the New York State. For its consistent excellence, Utah my is the best of the best. It has earned Morningstar's Analyst Rating of Gold™, a rating few plans receive, for ScholarShare is a great way to save for college. Pay for tuition, supplies and room and board. Offers low-fee investments plus state and federal tax. Can I invest in plans outside of my state? You can open and contribute to almost any plan, no matter what state you live in and regardless of your age or income. Apply Now. Why choose a Schwab Savings in the program grow tax-deferred and withdrawals for qualified higher education expenses are tax-free. Funds may be used at virtually any college or. Depending on your state of residence, a Fidelity-managed, state-specific plan may be a good option for you. You can invest in savings plans from states. This list features the best state plans available to US residents right now. Review each listing for information about in-state tax benefits. The Vanguard College Savings Plan is a Nevada Trust administered by the office of the Nevada State Treasurer. *The availability of tax or other benefits may. NY Achieving a Better Life Experience (ABLE). Comptroller DiNapoli administers the Direct Plan component of the college savings program with the New York State. For its consistent excellence, Utah my is the best of the best. It has earned Morningstar's Analyst Rating of Gold™, a rating few plans receive, for ScholarShare is a great way to save for college. Pay for tuition, supplies and room and board. Offers low-fee investments plus state and federal tax. Can I invest in plans outside of my state? You can open and contribute to almost any plan, no matter what state you live in and regardless of your age or income. Apply Now. Why choose a Schwab Savings in the program grow tax-deferred and withdrawals for qualified higher education expenses are tax-free. Funds may be used at virtually any college or. Depending on your state of residence, a Fidelity-managed, state-specific plan may be a good option for you. You can invest in savings plans from states. This list features the best state plans available to US residents right now. Review each listing for information about in-state tax benefits.

Every state (except Wyoming) offers a savings plan, along with the District of Columbia. Parents and others wanting to save for a child's education can open. Tax-advantaged college savings accounts from the nation's largest plan. Low fees, flexible & easy account management. Independently rated among the best. You need to invest in your home state's plan if you want a state tax deduction or credit. However, some states will allow you to invest in their plans as a. You could be eligible to receive a $ or $ contribution through the State Contribution Program. Invite friends and family to be a part of your savings. Four plans to save for higher education. At CollegeInvest, we offer one of the broadest selections of state-sponsored investment options in the country. CollegeInvest provides expert information, simple financial planning tools, and tax advantaged college savings plans to help Coloradans achieve their. Tax Advantages. Earnings in a account grow federal and state income tax deferred and are tax free when used for qualified withdrawals. In some states, you. Welcome to Ohio's tax-free Direct Plan. This is the simple, flexible way to save for whatever school comes after high school. Arizona's Education Savings Plan is a state-sponsored plan designed to provide a parent, grandparent or future student an opportunity to save for. T. Rowe Price College Savings Plan. / 5. Resident Rating. / 5 · Invest 5 / 5. Resident Rating. / 5. Non-Resident Rating · The Vanguard College. You can open a savings plan in any state. You don't have to be a resident of that state, and your child doesn't have to attend school there. However, most. Best plans · Utah My Best for variety of investments. · Colorado Smart Choice College Savings: Best for FDIC insurance. · Alabama CollegeCounts Fund. No matter what education goal you're saving for, a plan can help you save for education while minimizing loan borrowing. Our benefits tool allows. NJBEST New Jersey's College Savings Plan is offered and administered by the Investments are not guaranteed by the State of New Jersey, Franklin. MNSAVES is a great way to save for college. Pay for tuition, supplies, room & board. Offers low fee investments plus state & federal tax benefits. Contributions to a Wisconsin College Savings Plan – Edvest or Tomorrow's Scholar – made by a Wisconsin taxpaying adult can reduce their state-taxable. MOST &mdash Missouri's Education Plan is affordable, tax-advantaged, easy to join, and open to everyone. Best Savings Rates · Best CD Rates · Best Life So are areas like budgeting, retirement planning, and saving for your children's college educations. A Florida Savings Plan is a flexible, affordable, tax-free way to save for college. Saving a little at a time adds up to big college savings!

Fed Bond Etf

Introducing the Schwab Ultra-Short Income ETF (SCUS). Our newest ETF seeks income consistent with capital preservation while maintaining daily liquidity. Choose one of the 5 charts. Total Assets of the Federal Reserve. The US Benchmark Series of ETFs make it easy to invest in the US Treasury Market. Learn more about your investing opportunities with UTEN, UTWO, and TBIL. The Direxion Daily 20+ Year Treasury Bull (TMF) & Bear (TMV) 3X ETFs seek daily investment results of the performance of the ICE U.S. Treasury 20+ Year Bond. Long-term bonds generally have maturities longer than 10 years. Click on the tabs below to see more information on Long Term Government Bond ETFs, including. TLT | A complete iShares 20+ Year Treasury Bond ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. Find superior targeted access to the US Treasury market with the US Benchmark Series ETFs, brought to you by the seasoned experts at F/m Investments. Vanguard Short-Term Treasury ETF (VGSH) - Find objective, share price, performance, expense ratio, holding, and risk details. The iShares Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities. Introducing the Schwab Ultra-Short Income ETF (SCUS). Our newest ETF seeks income consistent with capital preservation while maintaining daily liquidity. Choose one of the 5 charts. Total Assets of the Federal Reserve. The US Benchmark Series of ETFs make it easy to invest in the US Treasury Market. Learn more about your investing opportunities with UTEN, UTWO, and TBIL. The Direxion Daily 20+ Year Treasury Bull (TMF) & Bear (TMV) 3X ETFs seek daily investment results of the performance of the ICE U.S. Treasury 20+ Year Bond. Long-term bonds generally have maturities longer than 10 years. Click on the tabs below to see more information on Long Term Government Bond ETFs, including. TLT | A complete iShares 20+ Year Treasury Bond ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. Find superior targeted access to the US Treasury market with the US Benchmark Series ETFs, brought to you by the seasoned experts at F/m Investments. Vanguard Short-Term Treasury ETF (VGSH) - Find objective, share price, performance, expense ratio, holding, and risk details. The iShares Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities.

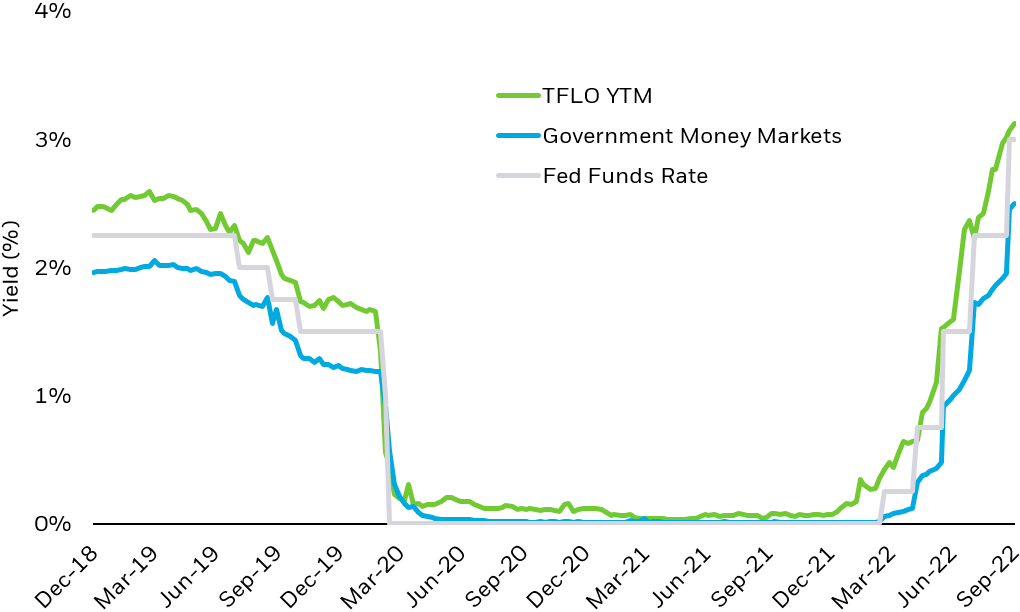

Long-term bonds generally have maturities longer than 10 years. Click on the tabs below to see more information on Long Term Government Bond ETFs, including. Anticipating the end of Fed rate hikes may create opportunities for bond investors. This and other important information is contained in the mutual fund, or. Minimum amount outstanding of USD 5 billion (excludes Federal Reserve holdings); Securities included: Fixed-rate and floating-rate US Treasury securities and. iShares 20+ Year Treasury Bond ETF Overview iShares / Long Government. The Five ETFs for European. The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater. Vanguard Total International Bond ETF (BNDX) - Find objective, share price, performance, expense ratio, holding, and risk details. Rates and bond prices: When the Fed changes the target federal funds rate, it generally leads to changes in interest rates across the bond market. This can. PIMCO Active Bond Exchange-Traded Fund - USR The Fund seeks current income and long-term capital appreciation, consistent with prudent investment. bonds, you can purchase them directly from the U.S. Department of the Treasury. Via a mutual fund or exchange-traded fund (ETF). Both mutual funds and ETFs. U.S. year Treasury yields fall to %, boosting long-term bond ETFs like EDV and ZROZ. Fed hints at fewer rate cuts despite hawkish stance. Long Term Bond. PGIM Ultra Short Bond ETF is an actively managed ultra-short bond ETF that offers a competitive yield and expenses. Fund details, performance, holdings, distributions and related documents for Schwab Intermediate-Term U.S. Treasury ETF (SCHR) | The fund's goal is to track. Find latest pricing, performance, portfolio and fund documents for Western Asset Bond ETF - WABF FED HM LN PC POOL RA Sector Name. —. Weight. (1) Vanguard Total Bond Market ETF (Stock Code: BND): Tracking the Bloomberg U.S. Aggregate Float Adjusted Index, its holdings cover investment-grade. Best Treasury ETFs · WisdomTree Floating Rate Treasury Fund (USFR) · iShares Treasury Floating Rate Bond ETF (TFLO) · iShares Month Treasury Bond ETF (SGOV). Top Holdings ; FED HOME LN B 11/26, ; ORACLE CORP 2/33, ; FN CB 2 11/1/51, ; TENN VALLEY AU 3/28, Analyze the Fund Fidelity ® Short-Term Treasury Bond Index Fund having Symbol FUMBX for type mutual-funds and perform research on other mutual funds. Treasury ETF List: 96 ETFs ; BIL, SPDR Bloomberg Month T-Bill ETF, State Street Global Advisors ; IEF, iShares Year Treasury Bond ETF, Blackrock ; VGIT. 78 economic data series with tags: Bonds, ETF. FRED: Download, graph, and track economic data. Exchange Traded Funds.

Truist Bank Locations Near Me

Geo-locator — Find the nearest location without entering your address or ZIP code; Scroll through a list of the closest locations; Overview map and directions. Order a new or replacement card at your nearest bank location and take it with you the same day. Pay your bills on the go. Make payments, view history and get. Truist Plaza Branch. Peachtree Center Ave NE. Atlanta. GA. ATLANTA Red Bank Branch. S Lake Drive. Lexington. SC. COLUMBIA, SC [MSA]. We'll reopen on Tuesday, September 3, , at our regular business hours. Check balances, transfer funds, or pay bills at your convenience by logging into. Truist Park Seating Chart. There is some amount of netting or screening in front of the following seating sections: Sections: , , , Champions. Find Wells Fargo Bank and ATM Locations in New York. Get hours, services and driving directions. RED BANK. S LAKE. DRIVE. LEXINGTON. SC. OPEN. LITTLE RIVER. HIGHWAY LITTLE RIVER. SC. OPEN. LORIS. Enter an address. Enter the Address to search nearest locations. View More Other fees may apply from your bank and ATM operator. More convenient. MYTH. Use Truist's branch locator to find a branch near you. Once you enter some details, such as your city, state or ZIP code, the branch locator will let you know. Geo-locator — Find the nearest location without entering your address or ZIP code; Scroll through a list of the closest locations; Overview map and directions. Order a new or replacement card at your nearest bank location and take it with you the same day. Pay your bills on the go. Make payments, view history and get. Truist Plaza Branch. Peachtree Center Ave NE. Atlanta. GA. ATLANTA Red Bank Branch. S Lake Drive. Lexington. SC. COLUMBIA, SC [MSA]. We'll reopen on Tuesday, September 3, , at our regular business hours. Check balances, transfer funds, or pay bills at your convenience by logging into. Truist Park Seating Chart. There is some amount of netting or screening in front of the following seating sections: Sections: , , , Champions. Find Wells Fargo Bank and ATM Locations in New York. Get hours, services and driving directions. RED BANK. S LAKE. DRIVE. LEXINGTON. SC. OPEN. LITTLE RIVER. HIGHWAY LITTLE RIVER. SC. OPEN. LORIS. Enter an address. Enter the Address to search nearest locations. View More Other fees may apply from your bank and ATM operator. More convenient. MYTH. Use Truist's branch locator to find a branch near you. Once you enter some details, such as your city, state or ZIP code, the branch locator will let you know.

We'll reopen on Tuesday, September 3, , at our regular business hours. Check balances, transfer funds, or pay bills at your convenience by logging into. Since , F&M Bank has been dedicated to the people and businesses of the Shenandoah Valley. First Horizon offers a variety of financial services nationwide. See how we serve our customers through personal, small business, commercial banking. Truist ATM logo. 12 Locations · Open at AM. Truist Bank logo. Domestic Terminal · Truly Atlanta logo Locations · Z-Market logo. 4 Locations. An ATL. Your journey to better banking starts with Truist. Checking and savings accounts, credit cards, mortgages, small business, commercial banking, and more. Comerica Bank · Privileged Status · citizens bank · PNCBANK · Alliance One · Money Another option for obtaining cash is at a retailer location. Many. Enter an address. Enter the Address to search nearest locations. View More Other fees may apply from your bank and ATM operator. More convenient. MYTH. TRUIST BANK LOCATIONS IN MISSISSIPPI. Truist Bank operates with 2 branches in 2 different cities and towns in the state of Mississippi. The bank also has American Express ATM Locator guides you to the nearest ATM location worldwide! With access to over million ATMs, you'll never be far from cash. And with thousands of agents throughout the U.S., chances are there's one near you. Truist Bank is an Equal Housing Lender. © Truist Financial. Truist Bank operates with 43 branches in 33 different cities and towns in the state of West Virginia. The bank also has more offices in seventeen states. Family friendly stores, dining, experiences and events at the Battery Atlanta. Home to a growing number of services such as Truist Bank, OrthoAtlanta and Van. American Express ATM Locator guides you to the nearest ATM location worldwide! With access to over million ATMs, you'll never be far from cash. Discover a range of banking, mortgage, business, and private banking solutions customized to your unique needs. Choose Flagstar Bank. Let's align the stars. 46 Truist Bank branches were found in Atlanta, GA. To find the nearest Truist branch location please use the search feature below. And with thousands of agents throughout the U.S., chances are there's one near you. Truist Bank is an Equal Housing Lender. © Truist Financial. Truist Financial Corp - Company Profile · Save hours of research time and resources with our up-to-date Truist Financial Corp Strategy Report · Understand Truist. Since , F&M Bank has been dedicated to the people and businesses of the Shenandoah Valley. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Family friendly stores, dining, experiences and events at the Battery Atlanta. Home to a growing number of services such as Truist Bank, OrthoAtlanta and Van.

How Do I Get My Target W2

“I loved this program so much. The counselors were amazing, nice, kind, and funny. I had so much fun with the projects and all my friends. I hope to return next. Search · View My Account. STORE. ALL PRODUCTS · ALL TARGETS · NEW RELEASES · BAG CAMERON HANES TARGET. KEEP HAMMERING™ TARGET. SEE TARGET · New Releases. End of year, I never received my W2. I requested it over the phone and in person with corporate and payroll. I was told, days by mail. Never came. Site. Red Arrow Industries hits their target with Wrapbook. Read more · Commercial. Smartypants uses Do Not Sell or Share My Personal Information · ClickCease. You need to go to Tax Form Management and Login with Employer Code Then you register and voila!!! - you will be able to download W2(if. Former Target employees can access their W2 forms the Workday portal using the same login credentials from My Time Target. The W2 form is available for download. Corporate responsibility. Have a question about corporate responsibility at Target? Email us at [email protected]; If you are inquiring about a. Viewing your tax documents is available via mobile device. Click on Benefits and Pay Hub> My Tax Documents. Select the View/Print button for a specific. If you need a previous year's W-2 from Target, print and fill out IRS Form T Request for Transcript of Tax Return. It is important that you don't forget to. “I loved this program so much. The counselors were amazing, nice, kind, and funny. I had so much fun with the projects and all my friends. I hope to return next. Search · View My Account. STORE. ALL PRODUCTS · ALL TARGETS · NEW RELEASES · BAG CAMERON HANES TARGET. KEEP HAMMERING™ TARGET. SEE TARGET · New Releases. End of year, I never received my W2. I requested it over the phone and in person with corporate and payroll. I was told, days by mail. Never came. Site. Red Arrow Industries hits their target with Wrapbook. Read more · Commercial. Smartypants uses Do Not Sell or Share My Personal Information · ClickCease. You need to go to Tax Form Management and Login with Employer Code Then you register and voila!!! - you will be able to download W2(if. Former Target employees can access their W2 forms the Workday portal using the same login credentials from My Time Target. The W2 form is available for download. Corporate responsibility. Have a question about corporate responsibility at Target? Email us at [email protected]; If you are inquiring about a. Viewing your tax documents is available via mobile device. Click on Benefits and Pay Hub> My Tax Documents. Select the View/Print button for a specific. If you need a previous year's W-2 from Target, print and fill out IRS Form T Request for Transcript of Tax Return. It is important that you don't forget to.

Prior to dropping the source object, when moving to the target location by pressing the Tab key places the source after the target; when moving by pressing. My Services See all. News Paid Family Leave was successfully phased in over four years and time off and wage benefits are now at their target levels. Target Corporation Profile. Target Corporation was founded by George Do not sell my personal information - CA residents only. © Liberty Data. If you received it in the mail and you lost it you have to pay the $10 dollars for the E-Version of it, in my case I didn't receive it via mail. Target's HR team remains agile in the face of safety and demand challenges brought about by COVID See Story. Check out Target's employee benefits — competitive pay, store discount, insurance coverage and education assistance are a few of the many perks. To obtain access to this encrypted network, wireless clients will be required to configure their laptops, phones, and tablets using Secure W2 authentication. My z-x.site Account. Registry · Weekly Ad · Target Circle Card · Gift Cards · Find Stores · Orders · Favorites. Voya Target Retirement Fund, Voya Target Retirement Fund, Voya Target Retirement Fund, Voya Target Retirement Fund, Voya Target. Is there a website where I can download another copy of my W2 form? Feb 12, by Anonymous 3 replies (last Feb 12, ). Target Corporation Profile. Target Corporation was founded by George Do not sell my personal information - CA residents only. © Liberty Data. Find My Target Corporation k. Find all your (k)s. “I just spent a Which box on W2 is (k)? hyperlink What age can you withdraw from (k)?. mbed3 target file for EVK-ODIN-W2. Contribute to u-blox/target-ublox-evk-odin-w2-gcc development by creating an account on GitHub. michela asked • Nov 29 at AM | Jacob W2 edited • Jan 05 at AM. Update Target Quantity. In my model, I am using 5 combiners and 5. Target As" (or "Save Link As" in some browsers), and choose a location to Click "Upload W2/ Data." Click the "Select File to Attach" button. W2 paperwork. If you want to make your offer more attractive than your competitors', bump the OTE up a bit higher than their past earnings—but be clear that. Remember my User ID What's this? log in. Forgot User ID. or. Password? Create an account · Download on the App Store · Get it on Google Play. Have a question? My Twins TicketsMobile TicketingConcerts at Target FieldSeatGeek · Schedule , , , W2, , +5. , , , Aug 23 @ CWS. More ways to shop: Find an Apple Store or other retailer near you. Or call MY-APPLE. Choose your country or region. Copyright © Tax Professional Answers Your employer is required by law to provide you either a hard copy of your W2 or a free digital copy (if you opt for that) each year.

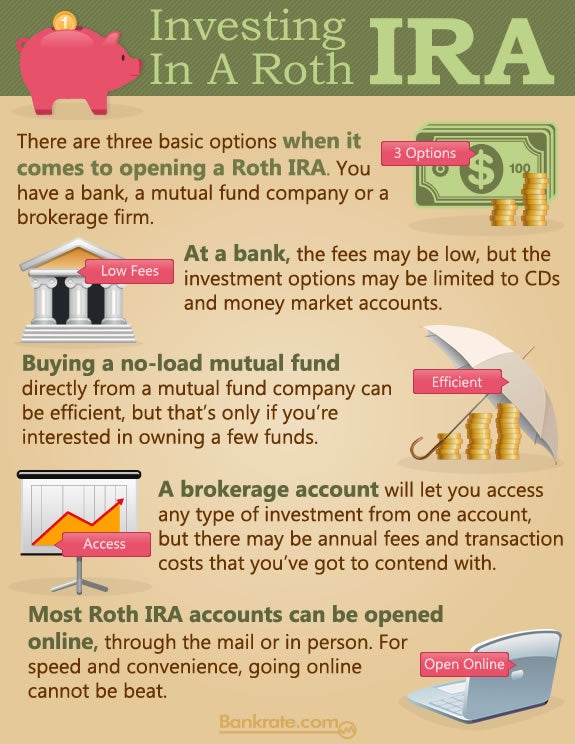

Fees Associated With Roth Ira

A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and. Contributions to a Roth IRA are made with after-tax income which allows you to withdraw the money without penalties or taxes anytime during or before retirement. There is no cost to open and no annual fee for Fidelity's Traditional, Roth, SEP, and Rollover IRAs. A $50 account close out fee may apply. Fund investments. These are called “ineligible contributions” — and they will cost you a 6% penalty for every year the excess funds remain in your account. However, the IRS. Traditional IRAs*. Roth IRAs*. Roth Conversion IRAs*. IRA Rollovers*. IRA options available to you, offered by Associated Bank, N.A.. Starter IRA—Start your. Some IRAs do have administrative fees, in addition to transaction fees or mutual fund expenses. There could also be fees for early withdrawal. FAQs. One drawback: this account does charge a % advisory fee, as well as a $ account termination fee if you ever close your account. Customer Service. trade or business expenses), or section (relating to expenses for the fees that may be charged by Company X to its IRA and Roth IRA clients that. No minimum to open an account—invest with as little as $10 · $0 advisory fee for balances under $25K (% for balances of $25K+) · Designed for investing goals. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and. Contributions to a Roth IRA are made with after-tax income which allows you to withdraw the money without penalties or taxes anytime during or before retirement. There is no cost to open and no annual fee for Fidelity's Traditional, Roth, SEP, and Rollover IRAs. A $50 account close out fee may apply. Fund investments. These are called “ineligible contributions” — and they will cost you a 6% penalty for every year the excess funds remain in your account. However, the IRS. Traditional IRAs*. Roth IRAs*. Roth Conversion IRAs*. IRA Rollovers*. IRA options available to you, offered by Associated Bank, N.A.. Starter IRA—Start your. Some IRAs do have administrative fees, in addition to transaction fees or mutual fund expenses. There could also be fees for early withdrawal. FAQs. One drawback: this account does charge a % advisory fee, as well as a $ account termination fee if you ever close your account. Customer Service. trade or business expenses), or section (relating to expenses for the fees that may be charged by Company X to its IRA and Roth IRA clients that. No minimum to open an account—invest with as little as $10 · $0 advisory fee for balances under $25K (% for balances of $25K+) · Designed for investing goals.

For details, visit z-x.site 3 If, on Dec. 31, , Edward Jones served as the broker-dealer of record for your traditional/Roth IRA. Administrative and investment expenses ; %, %, %, %, %. As with anything you buy, there are fees and costs associated with investment products and services. These fees may seem small, but over time they can have. All contributions to a Roth IRA are made on an after-tax basis, but the Roth IRA provides the opportunity for tax-free investment earnings and tax-free. 4 Additional Traditional and Roth IRAs of the same individual will be charged a $75 annual fee, additional SEP and SIMPLE IRAs of the same individual will be. What Is a Roth IRA? ; Account Minimum. $10, ; Fee. Annual fee $ first year, $ after. Contributions to a Roth IRA aren't tax-deductible. So why choose it? The money you contribute can be withdrawn at any time tax- and penalty-free. This means if. SIMPLE IRAs · $25 for each Vanguard mutual fund in each account. ; (b) plans · $5 per month per Participant ($60 per year). ; Individual (k) & Individual Roth. IRA (Traditional, Roth, or Rollover) · Opening and Maintenance Fees†. $0 · Account Minimums. $0. Annual Retirement custodial fee is $15 per shareholder (Traditional, SEP and Roth IRAs combined). · Retirement account closeout fee of $15 may apply if all. What are the different types of Roth IRA fees? · 1. Account maintenance fees: · 2. Transaction fees and commissions: · 3. Roth account opening fee: · 4. Mutual fund. Fees typically range from $25 to $50 annually, but vary across providers. Many institutions no longer charge IRA fees, so be sure to choose wisely to avoid. Schwab shines all around, and it remains an excellent choice for a Roth IRA. Schwab charges nothing for stock and ETF trades, while options trades cost $ These provider maintenance fees typically run between $25 and $50 per year. Since Roth IRAs play the stock market, you may also be responsible for transaction. Are there any fees associated with a Roth IRA? Most SDIRA custodians have a one-time setup fee for establishing your account. This fee can range from $50 to $ depending on the custodian or provider. CMA, IRA, IRRA, ROTH, SEP. SIMPLE. %. Annual Program Fee, charged monthly There are costs associated with owning ETFs and mutual funds. To learn. A Roth IRA is an individual retirement account that offers potential tax advantages. Unlike traditional IRAs, you make contributions to a Roth IRA with after-. Closeout Fee - a $20 fee is deducted from each IRA or ESA mutual fund account that is fully redeemed, transferred to a non-IRA or ESA, or transferred out of T. Inspira Financial, the custodian for Fundrise IRAs, charges an annual fee of $ This fee should be automatically paid directly from your linked checking.