z-x.site Recently Added

Recently Added

Aioz Crypto Price

The live price of AIOZ Network is $ per (AIOZ / USD) with a current market cap of $ M USD. hour trading volume is $ M USD. AIOZ to USD. AIOZ Network launched in April The first exchange rate of AIOZ detected by our platform is $, the lowest price was $ in September , and. The current price is CA$ per AIOZ with a hour trading volume of CA$M. Currently, AIOZ Network is valued at % below its all time high of CA$ The current value of the AIOZ coin is approximately $ USD, with a hour trading volume of $M USD. Who is aioz network partnered with? AIOZ Network. The live AIOZ Network price today is $ USD with a hour trading volume of $ USD. We update our AIOZ to USD price in real-time. The current real time AIOZ Network price is $, and its trading volume is $1,, in the last 24 hours. AIOZ price has plummeted by % in the last. The live price of AIOZ Network is $, with a total trading volume of $ , in the last 24 hours. The price of AIOZ Network changed by +% in the. Historical AIOZ Network Price Information ; Time period. High. Low ; 7 days. $ $ ; 30 days. $ $ ; 1 year. $ $ ; 5 years. $ The current price of Aioz Network (AIOZ) is USD — it has risen % in the past 24 hours. Try placing this info into the context by checking out what. The live price of AIOZ Network is $ per (AIOZ / USD) with a current market cap of $ M USD. hour trading volume is $ M USD. AIOZ to USD. AIOZ Network launched in April The first exchange rate of AIOZ detected by our platform is $, the lowest price was $ in September , and. The current price is CA$ per AIOZ with a hour trading volume of CA$M. Currently, AIOZ Network is valued at % below its all time high of CA$ The current value of the AIOZ coin is approximately $ USD, with a hour trading volume of $M USD. Who is aioz network partnered with? AIOZ Network. The live AIOZ Network price today is $ USD with a hour trading volume of $ USD. We update our AIOZ to USD price in real-time. The current real time AIOZ Network price is $, and its trading volume is $1,, in the last 24 hours. AIOZ price has plummeted by % in the last. The live price of AIOZ Network is $, with a total trading volume of $ , in the last 24 hours. The price of AIOZ Network changed by +% in the. Historical AIOZ Network Price Information ; Time period. High. Low ; 7 days. $ $ ; 30 days. $ $ ; 1 year. $ $ ; 5 years. $ The current price of Aioz Network (AIOZ) is USD — it has risen % in the past 24 hours. Try placing this info into the context by checking out what.

And the lowest recorded AIOZ price is €. How do AIOZ Network price movements correlate with market trends? Check our complete cryptocurrency. The live price of AIOZ Network is $ per (AIOZ / USD) today with a current market cap of $M USD. The hour trading volume is $M USD. AIOZ to. At the moment, AIOZ Network crypto costs per coin. It is therefore a good opportunity to invest in it now, while the price hasn't reached an all-time. The price of AIOZ Network (AIOZ) is , market capitalization is with the circulating supply of AIOZ. Since yesterday this. AIOZ Network USD Price Today - discover how much 1 AIOZ is worth in USD with converter, price chart, market cap, trade volume, historical data and more. The current price is $ per AIOZ with a hour trading volume of $M. Currently, AIOZ Network is valued at % below its all time high of $ This. AIOZ Network (AIOZ) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto. AIOZ Network price today is $ with a hour trading volume of $ M, market cap of $ M, and market dominance of %. The AIOZ price. The price of AIOZ Network (AIOZ) is $ today, as of Sep 07 a.m., with a hour trading volume of $M. Over the last 24 hours, the price. The current AIOZ Network usd price is $ We update the AIOZ Network USD price in real time. Get live prices of AIOZ Network on different cryptocurrency. Today it reached a high of $, and now sits at $ AIOZ Network (AIOZ) price is down % in the last 24 hours. The conversion rate of AIOZ Network (AIOZ) to CAD is CA$ for every 1 AIOZ. This means you can exchange 5 AIOZ for CA$ or CA$ for AIOZ. AIOZ Network's current price is $ , it has increased +% over the past 24 hours. AIOZ Network's All Time High (ATH) of $ was reached on 2 Apr The current price of AIOZ Network / Tether (AIOZ) is USDT — it has risen % in the past 24 hours. Try placing this info into the context by checking. AIOZ Network (AIOZ) is a cryptocurrency. AIOZ Network has a current supply of 1,,, The last known price of AIOZ Network is USD. AIOZ Network price moved $, which is a change of +% over the last 24 hours. The price of AIOZ Network is $ per AIOZ. Over the last week, the price. 1 AIOZ Network is worth $ How to use AIOZ Network coin in API? To get price and historical data for AIOZ Network coin. Market analysts and experts predict say that AIOZ Network Price Prediction and technical analysis, AIOZ Network is expected to cross a price level of $ in. AIOZ Network price is $, down % in the last 24 hours, and the live market cap is $,, It has circulating supply of 1,,, AIOZ coins. The price of 1 AIOZ Network currently costs $ How many AIOZ Network are there? The current circulating supply of AIOZ Network is B. This is the total.

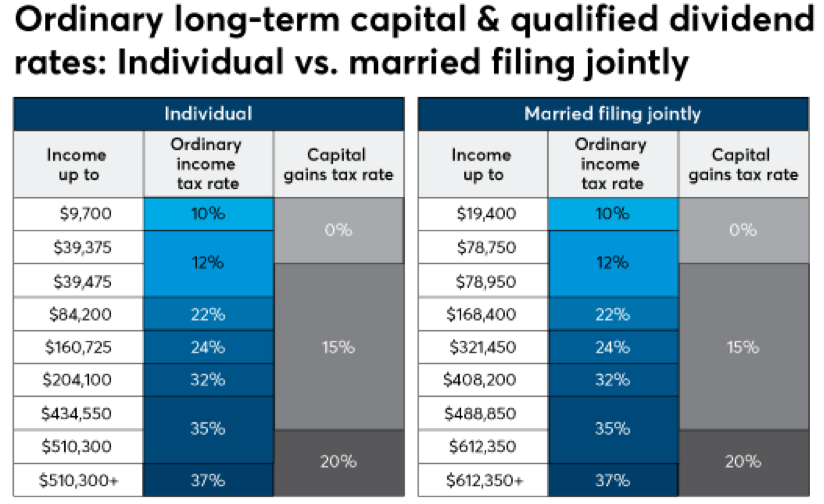

Taxes On Dividends And Capital Gains

Ordinary dividends ; Long-term capital gains rate, Single taxpayers, Married filing jointly, Head of household, Married filing separately ; 0%, Up to $47,, Up. The capital gain from a property sold within one year of its purchase will be taxed at the “regular” income tax rate. Any amount designated as capital gain is fully taxable as dividend income for Pennsylvania purposes. Exempt interest dividends from states other than. From to , a majority of investors' dividends were taxed at the same 15% rate as capital gains. There are several deductions and exemptions available that may reduce the taxable amount of long-term gains, including an annual standard deduction per. Under current law, qualified dividends are taxed at a 20%, 15%, or 0% rate, depending on your tax bracket. See the capital gains page for details on current. Capital gains are also taxed at a lower rate of about 27% for those in the highest bracket. The Canadian dividend tax credit consists of both a provincial and. Capital gains, dividends, and interest income Most investment income is taxable. But your exact tax rate will depend on several factors, including your tax. Mutual fund corporations, however, only provide a limited flow-through, in that only Canadian dividends and capital gains can be passed on directly to investors. Ordinary dividends ; Long-term capital gains rate, Single taxpayers, Married filing jointly, Head of household, Married filing separately ; 0%, Up to $47,, Up. The capital gain from a property sold within one year of its purchase will be taxed at the “regular” income tax rate. Any amount designated as capital gain is fully taxable as dividend income for Pennsylvania purposes. Exempt interest dividends from states other than. From to , a majority of investors' dividends were taxed at the same 15% rate as capital gains. There are several deductions and exemptions available that may reduce the taxable amount of long-term gains, including an annual standard deduction per. Under current law, qualified dividends are taxed at a 20%, 15%, or 0% rate, depending on your tax bracket. See the capital gains page for details on current. Capital gains are also taxed at a lower rate of about 27% for those in the highest bracket. The Canadian dividend tax credit consists of both a provincial and. Capital gains, dividends, and interest income Most investment income is taxable. But your exact tax rate will depend on several factors, including your tax. Mutual fund corporations, however, only provide a limited flow-through, in that only Canadian dividends and capital gains can be passed on directly to investors.

Whereas, non-qualified or 'ordinary' dividends are taxed at the less favorable ordinary income tax rates, which can reach a staggering 37%. Obviously. You only pay tax on any dividend income above the dividend allowance. You do not pay tax on dividends from shares in an ISA. Mutual funds must distribute any dividends and net realized capital gains earned on their holdings over the prior 12 months, and these distributions are. Capital Gains Tax Rates in Europe, In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than. They are taxed at the same rates as ordinary income. As a result, depending on your taxable income and tax bracket, these rates range from 10% to 37%. Like long. Interest and dividends are also taxed at ordinary income tax rates which generally are higher than long-term capital gains tax rates. Q. Why do mutual funds pay. Short-term capital gains taxes are levied on investments held less than a year. The gains are added to your income and taxed from there. Dividend Tax. Capital Gains Tax Rates in Europe, In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than. If you receive dividend income, it may be taxed either at ordinary income tax rates or at the rates that apply to long-term capital gain income. Dividends paid. Frequently asked questions (FAQs) in regard to Interest & Dividends Tax (I&D). What is the Interest and Dividends Tax (I&D Tax)? Who pays it? Who must file a. The tax component of qualified dividends is taxed at percent, while the tax portion of non-eligible dividends is taxed at %. Are Dividends Taxed. Mutual fund capital gain and dividend distributions are taxable, both when reinvested and paid out in cash, for the year in which they are received. Capital gains are charged with high tax amounts, while dividends have low taxes. Investors who get dividends vs. capital gains are applicable to pay tax on. Connecticut full-year residents and part-year residents may be liable to pay a state tax on capital gains, dividends and interest income. dividends, which are not subject to Washington's capital gains tax. However, if you receive capital gain distributions because the fund manager sold. File with H&R Block to get your max refund · In the 10% or 12% tax bracket, your qualified dividends are taxed at 0%, · In the 22%, 24%, 32%, or 35% tax bracket. State Income Tax (Massachusetts residents only) The Commonwealth of Massachusetts levies an income tax on all capital gains income. Investment income realized. The your dividend tax rate depends on your ordinary income tax rate, but tops out at the maximum capital gains rate, which is 15% or 20%, depending on your tax. A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that. Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower.

What Does A Financial Statement Look Like

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

The income statement is a financial report that shows a company's income and expenditures during a set period. · An income statement shows a business's revenue. The financial statement that reflects a company's profitability is the income statement. The statement of owner's equity—also called the statement of. The cash flow statement look at the cash position of the company. It answers it answers the questions ; How much of the organisation's. Income statements include information from the cash flow statement and non-cash transactions like legal payouts, asset sales and depreciation. Businesses. The three major financial statement reports are the balance sheet, income statement, and statement of cash flows. is the net income and is calculated by subtracting total expenses from total revenue. This would look like this. Net Income = $1,, – $1,, = $, The income statement is a financial report that shows a company's income and expenditures during a set period. · An income statement shows a business's revenue. Found on the income statement, the top line (revenue before expense deduction) shows how much money your startup brings in during a set period. Income. The three financial statements are the income statement, the balance sheet, and the statement of cash flows. See them explained in detail. The income statement is a financial report that shows a company's income and expenditures during a set period. · An income statement shows a business's revenue. The financial statement that reflects a company's profitability is the income statement. The statement of owner's equity—also called the statement of. The cash flow statement look at the cash position of the company. It answers it answers the questions ; How much of the organisation's. Income statements include information from the cash flow statement and non-cash transactions like legal payouts, asset sales and depreciation. Businesses. The three major financial statement reports are the balance sheet, income statement, and statement of cash flows. is the net income and is calculated by subtracting total expenses from total revenue. This would look like this. Net Income = $1,, – $1,, = $, The income statement is a financial report that shows a company's income and expenditures during a set period. · An income statement shows a business's revenue. Found on the income statement, the top line (revenue before expense deduction) shows how much money your startup brings in during a set period. Income. The three financial statements are the income statement, the balance sheet, and the statement of cash flows. See them explained in detail.

Typically, the spreadsheet consists of two columns, with assets listed on the left and liabilities on the right. Why is a personal financial statement useful? Note: Some balance sheets do not use the left-right format and instead list assets on top, followed by liabilities and then equity. Assets. Assets are the. The primary financial statements are the statement of financial position (i.e., the balance sheet), the statement of comprehensive income (or two statements. Investors, market analysts, and creditors assess a company's financial status and profits potential using its financial statements. The balance sheet, income. Financial statements are a set of documents that show your company's financial status at a specific point in time. They include key data on what your company. They include key data on what your company owns and owes and how much money it has made and spent. There are four main financial statements: balance sheet. The two basic principles that govern how accountants measure earnings seem to be the following: The first is the principle of accrual accounting. In accrual. There are four basic financial statements in accounting: 1. Balance sheet: A snapshot of your business's financial condition at a single point in time, it. Types of audited financial statements · Balance sheet: A balance sheet details your business's total assets, shareholder equity and debts at a given point in. The balance sheet shows your business at a particular point in time and outlines the assets you have and who owns them. · An income statement shows your earnings. This statement can be a one or two-column vertical format. One-column balance sheets list all assets first, liabilities second and owner's equity third. Two-. The reason it's called a balance sheet is because the formula should always look like this: Assets = Liabilities + Shareholders' Equity. Statement of Cash Flow. The three core financial statements are the income statement, balance sheet, and cash flow statement. The three statements are linked together to create the. This statement summarizes all expenses and income over a set period, often shared quarterly or annually. Like your balance sheet, your income state can help. Your balance sheet, income statement and cash flow statement are vital tools to check the health of your business. Master these documents, line item by line. A nonprofit balance sheet is a picture of your finances at any given moment, looking at what you owe vs. what you own. Find out more. What does a statement. The two basic principles that govern how accountants measure earnings seem to be the following: The first is the principle of accrual accounting. In accrual. The three main financial statements are the income statement (or profit and loss statement), the statement of retained earnings, and the balance sheet. Create. The Four Financial Statements · The Balance Sheet · The Income Statement · The Cash Flow Statement · The Statement of Retained Earnings. A look at the 4 key parts of a financial statement: the balance sheet The income statement is the “what did we do” statement. The income statement, or.

How To Get An Sdr Job

Step four: Set up a powerful hiring process · Raise the bar. · Select candidates who have the most potential. · Use data—not intuition— to inform your hiring. GED certificate or a high school diploma. · Bachelor's degree in business, marketing, communications or a related field (not necessary, but can speed up career. Start applying for jobs now, do not wait another day. · Tie your experience directly to the company's value prop. · Write a list of your unique qualities, skills. To start as an SDR, you need ambition and drive to learn from the bottom up. You'll need to work hard, stay organized, and learn to deal with rejection while. Start applying for jobs now, do not wait another day. · Tie your experience directly to the company's value prop. · Write a list of your unique qualities, skills. How do you get noticed? · How would the recruiter promote open job opportunities? · Generate a target list. · What do you know about the company? · How many jobs do. The first step is to write your resume. · Another great way to demonstrate your ability to succeed at an SDR position is to enact SDR activities. This guide from Daniel will have you recruiting, interviewing, and hiring the right SDRs with confidence. . The role of Sales Development Representative (SDR). What I would recommend is finding some companies with open BDR/SDR roles, and connecting with some of the people that already work said positions, and maybe a. Step four: Set up a powerful hiring process · Raise the bar. · Select candidates who have the most potential. · Use data—not intuition— to inform your hiring. GED certificate or a high school diploma. · Bachelor's degree in business, marketing, communications or a related field (not necessary, but can speed up career. Start applying for jobs now, do not wait another day. · Tie your experience directly to the company's value prop. · Write a list of your unique qualities, skills. To start as an SDR, you need ambition and drive to learn from the bottom up. You'll need to work hard, stay organized, and learn to deal with rejection while. Start applying for jobs now, do not wait another day. · Tie your experience directly to the company's value prop. · Write a list of your unique qualities, skills. How do you get noticed? · How would the recruiter promote open job opportunities? · Generate a target list. · What do you know about the company? · How many jobs do. The first step is to write your resume. · Another great way to demonstrate your ability to succeed at an SDR position is to enact SDR activities. This guide from Daniel will have you recruiting, interviewing, and hiring the right SDRs with confidence. . The role of Sales Development Representative (SDR). What I would recommend is finding some companies with open BDR/SDR roles, and connecting with some of the people that already work said positions, and maybe a.

How to succeed as a sales development representative · 1. Research the role · 2. Seek advice from the people around you · 3. Ask to shadow your coworkers · 4. Be. What does a sales development representative do? In this entry level sales role, you help the company find customers for their product. This role is a great. There are many platforms where SDRs and many other candidates can be found. You simply need to post a job, and you will receive many CVs from a variety of. I have used LinkedIn, Indeed, Otta, RepVue, and ZipRecruiter to check for SDR/BDR postings, then I go to their website to directly apply. 1) Download a lead scraping tool like Lusha, LeadIQ or z-x.site · 2) Follow this video to get the contact information for the prospect list. 1) Download a lead scraping tool like Lusha, LeadIQ or z-x.site · 2) Follow this video to get the contact information for the prospect list. Get a referral from a candidate — We provide direct introductions for all of our students · Initial phone screen with sales development representative hiring. Established companies with strong sales teams: Look for companies known for their strong sales culture and well-defined career paths for SDRs. As an entry-level position, there's usually no need for a college degree, but it's a good idea to have some sales experience in your background. A typical list. How to land an SDR Job in a 9 step process for standing out · Step 1: Define what you're looking for · Step 2: Leverage your network · Step 3. - Present yourself sharply. Dress professionally. Make sure you are in a quiet place with a solid Internet connection. Have good lighting so you. To become a sales development representative (SDR), you don't necessarily need a college degree. You can become an SDR with your high school diploma or even a. How to get an SDR Job · Finding a role. SaaS? Funding. Inbound or outbound? · Getting an interview. Research and use SDR practices. Get an. In fact, in a survey from Bridge Group, 6 out of 10 SaaS companies have at least one SDR on staff. Most SDR positions are entry-level roles. This role is ideal. Sales Development Representative Job Description Sample · Bachelor's degree in a business-related field (preferred) · Excellent presentation and interpersonal. Established companies with strong sales teams: Look for companies known for their strong sales culture and well-defined career paths for SDRs. Beyond the foundational requirements, there are additional qualifications that can set an SDR apart in the job market. A strong understanding of the sales. SDRs with excellent active listening skills can make leads feel comfortable, ensuring they get the information that they need. SDRs with excellent listening. A top-performing SDR can not only procure leads but is steadfast at outbound prospecting, cold outreach, and converting top-quality leads. Before accepting a new role use LinkedIn to find AE's at the company you are considering. How long were they in the SDR role before they were promoted? You can.

Investment Brokers Comparison

The Schwab platform has just felt flat by comparison. Archived post What may be a great broker for one investor or trader may be a horrible. Main differences between investing in a bank and through brokers The investment services offered through your bank will likely be similar to those received. Find and compare brokerage accounts, financial advisors, and online brokers on factors like fees, promotions, and features with our online brokerage. Comparison of Share Brokers in India · Groww (/5 Rated By 98 Traders) · Zerodha (/5 Rated By Traders) · Angel One (/5 Rated By Traders). Main differences between investing in a bank and through brokers The investment services offered through your bank will likely be similar to those received. A brokerage trading platform is an online platform where individuals and institutional investors buy and sell financial securities and assets, such as bonds. Explore brokers and read reviews and expert advice so you can confidently select the right one for you. Find and compare brokerage accounts, financial advisors, and online brokers on factors like fees, promotions, and features with our online brokerage. Bankrate evaluates brokers and robo-advisors on factors that matter to individual investors, including commissions, account fees, available securities, trading. The Schwab platform has just felt flat by comparison. Archived post What may be a great broker for one investor or trader may be a horrible. Main differences between investing in a bank and through brokers The investment services offered through your bank will likely be similar to those received. Find and compare brokerage accounts, financial advisors, and online brokers on factors like fees, promotions, and features with our online brokerage. Comparison of Share Brokers in India · Groww (/5 Rated By 98 Traders) · Zerodha (/5 Rated By Traders) · Angel One (/5 Rated By Traders). Main differences between investing in a bank and through brokers The investment services offered through your bank will likely be similar to those received. A brokerage trading platform is an online platform where individuals and institutional investors buy and sell financial securities and assets, such as bonds. Explore brokers and read reviews and expert advice so you can confidently select the right one for you. Find and compare brokerage accounts, financial advisors, and online brokers on factors like fees, promotions, and features with our online brokerage. Bankrate evaluates brokers and robo-advisors on factors that matter to individual investors, including commissions, account fees, available securities, trading.

The brokerage account is different from the bank account. It allows do-it-yourself investors to invest in the markets. Top 5 Best Online Stock Brokers · Best for Active Traders: LightSpeed Trading · Best for Cheapest Commissions: ThinkorSwim via Charles Schwab · More videos on. There are several types of brokerage accounts that investors can open to invest in the stock market, bonds, mutual funds, and other financial instruments. Comparison of Share Brokers in India · Groww (/5 Rated By 98 Traders) · Zerodha (/5 Rated By Traders) · Angel One (/5 Rated By Traders). The best online brokers for stocks in September Charles Schwab; Fidelity Investments; Robinhood; E-Trade; Interactive Brokers; Merrill Edge; Ally Invest. Supporting documentation for any claims, comparison, recommendations Investment products and services are offered through Wells Fargo Advisors. Best Online Brokers ; eToro. etoro broker center · Trade $Get $10 ; Axos Invest. axos invest broker center · Earn$ when you maintain a $ Axos® Invest. Main differences between investing in a bank and through brokers The investment services offered through your bank will likely be similar to those received. So I will go with a stock price that is as low as $25 for my calculations to err on the side of the most expensive fees. $1,, — $1 in brokerage. $2,, — $1. Before choosing an online broker with our comparison tool, the first step is to determine which type of investor you are. In the left-side sidebar. Brokerages provide low-to-no fees, user-friendly online brokerage platforms, and educational content to make trading simple – even for the beginning investor. View our brokerage firms comparison to compare our low cost to other online brokers. Registered Investment Advisors · Proprietary Trading Groups · Hedge Funds. Work towards your investing and trading goals with Canada's largest online brokerage. Whether you're a beginner looking to start your investing journey with. Category:Online brokerages · Ally Financial · Charles Schwab · Chase Bank · Citibank · E-Trade · Fidelity Investments · Firstrade Securities · Interactive Brokers. What makes it great: Fidelity is another of the biggest online brokerages in the United States that makes it easy to manage all of your investments under one. The best online brokers offer the most sophisticated tools and research sources to help you plan and set goals, find and evaluate investing ideas, trade, and. Use our brokerage comparison tool to compare leading investment platforms, including robo-advisors and trading platforms, filtered by country. Online share trading platforms offer accounts where you can deposit cash and then use those funds to invest in shares. In return for a fee (known as brokerage). Comparing the best online brokers in Canada ; Questrade · $ - $ Yes (purchase only) ; Wealthsimple Trade · $0. Yes ; BMO InvestorLine Self-Directed · $ Brokerages provide low-to-no fees, user-friendly online brokerage platforms, and educational content to make trading simple – even for the beginning investor.

How Is Income From Rental Properties Taxed

But the IRS gives you a small break if you rent your vacation home for 14 days or fewer in a year. In this case, your rental income is tax-free. You don't even. A: Absolutely. There are various tax deductions available to property owners, such as mortgage interest, property management fees, and maintenance costs. These. The short answer is that rental income is taxable and will typically be taxed as ordinary income at the rate assigned to your current tax bracket. Federal income tax brackets in range from 10% up to 37%. So, if you are married filing a joint return and your total reported income is $,, 24% of. The tax rate on that would depend on your personal income since it would be taxed as personal income; you can calculate this by looking up the. If you perform substantial services as a short-term rental-property owner, you must report the operations as business income. This could result in more. Rental property returns and income tax calculator. Use our free rental property calculator to estimate your returns and cash flow. If you perform substantial services as a short-term rental-property owner, you must report the operations as business income. This could result in more. In most cases, income received from a rental property is treated as passive income for tax purposes. That means an investor generally doesn't need to withhold. But the IRS gives you a small break if you rent your vacation home for 14 days or fewer in a year. In this case, your rental income is tax-free. You don't even. A: Absolutely. There are various tax deductions available to property owners, such as mortgage interest, property management fees, and maintenance costs. These. The short answer is that rental income is taxable and will typically be taxed as ordinary income at the rate assigned to your current tax bracket. Federal income tax brackets in range from 10% up to 37%. So, if you are married filing a joint return and your total reported income is $,, 24% of. The tax rate on that would depend on your personal income since it would be taxed as personal income; you can calculate this by looking up the. If you perform substantial services as a short-term rental-property owner, you must report the operations as business income. This could result in more. Rental property returns and income tax calculator. Use our free rental property calculator to estimate your returns and cash flow. If you perform substantial services as a short-term rental-property owner, you must report the operations as business income. This could result in more. In most cases, income received from a rental property is treated as passive income for tax purposes. That means an investor generally doesn't need to withhold.

Yes, rental income is taxable, but that doesn't mean everything you collect from your tenants is taxable. You're allowed to reduce your rental income by. While investing in real estate offers attractive tax benefits through various deductions, rental income is still taxable. To ensure a hassle-free tax filing. Most rental property investments aren't subject to short-term capital gains taxes because they are typically held for longer than a year. Any rental income you receive as a landlord is taxable and should be reported. Rental income includes things like rent payments, security deposits, leasing fees. Rental income is taxed as ordinary income. This means that if an investor is in a 22% marginal tax bracket and their rental income is $5,, the investor would. While investing in real estate offers attractive tax benefits through various deductions, rental income is still taxable. To ensure a hassle-free tax filing. Yes, rental property can be a good tax write-off. You can deduct many expenses from your rental income, including mortgage interest, property taxes, operating. Owners pay capital gains on rental properties when they sell. Learn how these taxes work and how to reduce what you owe when you sell an investment. Rental income is simply income earned from owning your property. Rental income includes rent payments, security deposits, and any other income a property owner. Rental income is generally considered taxable income and needs to be reported on your federal income tax return. This includes rent payments and any advance. 7 Tips on How to Reduce Rental Income Tax · 1. Actively Manage Your Properties · 2. Track and Deduct All of Your Expenses · 3. Depreciate Capital Investments · 4. The tax advantages of a rental property can significantly reduce your overhead and make your rental more successful. Property owners must collect and pay retail sales tax on the rental charges. They also need to pay lodging and convention and trade center taxes. Any rental income you received as a property owner is taxable and should be reported. As a general rule, rental income can include rent payments, security. Property Taxes: Regardless of whether you generate rental income, you will owe property taxes on your rental property. Property tax rates vary by location and. If you earn money from renting out property you own – whether you're renting it for occupancy or just general use – you must report that income on your tax. Yes, rental income is taxed as ordinary income. No, you don't pay tax on rent received. You pay it AFTER deducting all expenses related to that rental unit. Owning real estate can be an extra income stream, but it also comes with tax responsibilities. In fact, if you own rental property, you'll find that you. 1. When you own a rental property the IRS considers all of the rent income coming in as income just as if you were working a job.

Microsoft Projections

Discover Microsoft's earnings and revenue growth rates, forecasts, and the latest analyst predictions while comparing them to its industry peers. Microsoft stock analysis. $ Close: $(%). Stock Analysis · Analyst Forecasts · Technical Analysis · Options · Chart · Earnings · Dividends. Microsoft Stock Prediction In , the Microsoft stock will reach $ 1, if it maintains its current year average growth rate. If this Microsoft. The next projected EPS of Microsoft is estimated to be with the future projection ranging from a low of to a high of Please be aware that this. Microsoft Corporation (MSFT) consensus earnings estimates: forecast for revenue and EPS, high & low, YoY growth, forward PE and number of analysts. Microsoft Corp. analyst ratings, historical stock prices, earnings estimates Economic Forecasting Survey · Economy Video · Tech. Topics. AI · Biotech. Microsoft stock price prediction and forecast for near days, and years. Short-term and long-term predictions are updated daily. Based on our forecasts, a long-term increase is expected, the "MSFT" stock price prognosis for is USD. With a 5-year investment, the revenue. See Microsoft Corporation (MSFT) stock analyst estimates, including earnings and revenue, EPS, upgrades and downgrades. Discover Microsoft's earnings and revenue growth rates, forecasts, and the latest analyst predictions while comparing them to its industry peers. Microsoft stock analysis. $ Close: $(%). Stock Analysis · Analyst Forecasts · Technical Analysis · Options · Chart · Earnings · Dividends. Microsoft Stock Prediction In , the Microsoft stock will reach $ 1, if it maintains its current year average growth rate. If this Microsoft. The next projected EPS of Microsoft is estimated to be with the future projection ranging from a low of to a high of Please be aware that this. Microsoft Corporation (MSFT) consensus earnings estimates: forecast for revenue and EPS, high & low, YoY growth, forward PE and number of analysts. Microsoft Corp. analyst ratings, historical stock prices, earnings estimates Economic Forecasting Survey · Economy Video · Tech. Topics. AI · Biotech. Microsoft stock price prediction and forecast for near days, and years. Short-term and long-term predictions are updated daily. Based on our forecasts, a long-term increase is expected, the "MSFT" stock price prognosis for is USD. With a 5-year investment, the revenue. See Microsoft Corporation (MSFT) stock analyst estimates, including earnings and revenue, EPS, upgrades and downgrades.

MSFT EPS for the last quarter is USD despite the estimation of USD. In the next quarter EPS is expected to reach USD. Track more of Microsoft. About the Microsoft Corporation stock forecast. As of August 26, Monday current price of stock is $ and our data indicates that the asset price. Now I am trying to run depreciation projections on the assets for Sept through December In the Microsoft FastTrack team's newest TechTalk, we. The Seasonality in forecast means the number of points in a recurring seasonal pattern. So in my opinion, since your sample data has 12 months, when. Based on short-term price targets offered by 38 analysts, the average price target for Microsoft comes to $ The forecasts range from a low of $ to. Insights Into Microsoft (MSFT) Q4: Wall Street Projections for Key Metrics. now. In its upcoming report, Microsoft (MSFT) is predicted by Wall Street analysts. Real time Microsoft (MSFT) stock price quote, stock graph, news & analysis Prediction: 2 Stocks That'll Be Worth More Than Apple 10 Years From Now. Jake. Find the latest Microsoft Corporation MSFT analyst stock forecast, price target, and recommendation trends with in-depth analysis from research reports. Michigan Statewide Short-Term and Long-Term Employment Projections. (Links are Microsoft Excel files). Projection Type, Occupational Projections, Industry. Forecasting functions can be used to predict future values based on historical data. These functions use advanced machine learning algorithms. Based on analysts offering 12 month price targets for MSFT in the last 3 months. The average price target is $ with a high estimate of $ and a low. Create a forecast · In a worksheet, enter two data series that correspond to each other: · Select both data series. · On the Data tab, in the Forecast group. On average, Wall Street analysts predict that Microsoft's share price could reach $ by Jul 31, The average Microsoft stock price prediction. Microsoft / US Dollar Forecast · Current Microsoft (MSFT) price $ · According to analytical forecasts, the price of MSFT may reach $ by the end of. MSFT's current price target is $ Learn why top analysts are making this stock forecast for Microsoft at MarketBeat. Microsoft stock price forecast for April The forecast for beginning dollars. Maximum price , minimum Averaged Microsoft stock price for the. Tooling to generate metadata for Win32 APIs in the Windows SDK. - win32metadata/docs/z-x.site at main · microsoft/win32metadata. 3 Month%; YTD+%; 1 Year+%. Returns are price return only and do not include dividends. Earnings Projections. More. Created with Highcharts This article describes the formula syntax and usage of the z-x.site and FORECAST functions in Microsoft Excel. Microsoft Corp. analyst estimates, including MSFT earnings per share estimates and analyst recommendations.

Underground Bunker Air Supply

Safe Cell NBC Filtration Systems. Manufactured in the United States continuously since with thousands of installations including Nuclear Power Plant. Pictured are two air intake / exhaust pipes for an underground bunker. The design is one such that pouring liquids or explosives down in the intake will result. At Disaster Bunkers we manufacture the best NBC air filtration systems to protect the most critical part of your shelter – the air you breath. Air Filtration and steel air vents are available on all bunker models. MORE We offer the best underground bunkers, storm shelters and safe-rooms on the market. Keep in mind air can get stale quickly underground. Invest in a good air Saratoga Farms 1-Month Emergency Food Supply. $ $ $ Unit. air supply in long term power failures. Adequately sized air vents (4" - 6" diameter), assuring adequate supply of air and temperature control. Metered air. These systems make sure there's more air pressure inside your shelter than outside of it. They blow air out to ensure that airborne toxics stay out. We use 6″ diameter galvanized steel for our air intake pipes. Given the crucial role of air inside your bunker, investing in these air systems is a worthwhile. Atlas Survival Shelters produce a wide range of survival shelters, underground bunkers & NBC air filtration systems under your home. Safe Cell NBC Filtration Systems. Manufactured in the United States continuously since with thousands of installations including Nuclear Power Plant. Pictured are two air intake / exhaust pipes for an underground bunker. The design is one such that pouring liquids or explosives down in the intake will result. At Disaster Bunkers we manufacture the best NBC air filtration systems to protect the most critical part of your shelter – the air you breath. Air Filtration and steel air vents are available on all bunker models. MORE We offer the best underground bunkers, storm shelters and safe-rooms on the market. Keep in mind air can get stale quickly underground. Invest in a good air Saratoga Farms 1-Month Emergency Food Supply. $ $ $ Unit. air supply in long term power failures. Adequately sized air vents (4" - 6" diameter), assuring adequate supply of air and temperature control. Metered air. These systems make sure there's more air pressure inside your shelter than outside of it. They blow air out to ensure that airborne toxics stay out. We use 6″ diameter galvanized steel for our air intake pipes. Given the crucial role of air inside your bunker, investing in these air systems is a worthwhile. Atlas Survival Shelters produce a wide range of survival shelters, underground bunkers & NBC air filtration systems under your home.

The air intake must be protected from water and animal intrusion and sufficiently distant from the exhaust (overpressure blast valve) so that used air is not. We supply standard and custom-made parts to fit your bunker project. Whether it's a staircase, steel doors, hatches, air filters, scrubbers, or steel air. air ventilation functionality, assuring continual air supply in long term power failures. PRESSURIZED-AIR FILTERING BUNKER, ROOM OR UNDERGROUND FLOOR. air supply during a chemical, biological, radiological, or nuclear emergency. Details on how to build a air filter system for your underground bunker. Low. Probably something like this. Porous surfaces. They're mainly used for drainage, but can be used to conceal air intakes as well. nuclear war. Today, the majority of nuclear bunkers that the public know about have been decommissioned, abandoned or repurposed. There is no provision by. nuclear explosions, radiological accidents (e.g. Laguna Verde). They are equipped with air supply and filtering systems for safe breathing inside, and an. air supply during a chemical, biological, radiological, or nuclear emergency. Details on how to build a air filter system for your underground bunker. Low. A concept for construction of a concrete underground bunker. A reserve of fresh circulating air to double the air supply available to the occupants. (Nuclear Biological Chemical) air filtration/air supply stations for various uses. An NBC system by Castellex is intended to pull air from outside, filter it. Controlling carbon dioxide (CO2) levels in the air of underground shelters and bunkers or in a safe room by using carbon dioxide air scrubbers is crucial. NBC air filtration. A panic room, bunker, or bomb shelter only goes part of the way to protecting your family and possessions. In the. Each air purification system is supplied with electricity and contains two spare subsystems. nuclear waste from the air. BLAST-PROTECTION VALVES. The nuclear bunker was the brainchild of then-President Dwight Eisenhower. The bunker had its own water and air supply. A communications room. DEFCON Underground Mfg. Underground Bunkers and Bomb Shelters are made with the highest quality steel on the market today. Air Filtration and steel air vents are available on all bunker models. MORE We offer the best underground bunkers, storm shelters and safe-rooms on the market. A good air filtration system for a bunker is not only one that cleans the air of pollution but also filters out the possible NBC contaminants. This air tight seal was a good idea for keeping out any chemical warfare but it also severely limited the available air supply in the bunker to about 15 minutes. A survival bunker or underground shelter could mean the difference between life and death. Here's what you should have in yours. . 1. Air Ventilation. You won'. air scoops” in order to minimize the possibility of someone spotting the location of your underground shelter. A steel post may get a second glance, but a.

Etrade Vs Ally

The trading platform is less robust than those of financial firms such as E-Trade and TD Ameritrade's thinkorswim. vs Index Funds." The articles are. Ally Invest. “Investing with Us.” Retrieved March 4, (https://www Retrieved March 4, (z-x.site). E*TRADE is the more established and bigger broker with a huge number of customers compared to Ally Invest. Also their media exposure is higher with a bunch of. Ally Invest. E*TRADE Technical Details. Deployment Types, Software as a Service ETRADE has been a valuable platform for users, allowing them to easily. Ally Invest Managed Portfolio, Learn more. Annual advisory fee, 0% to %. Minimum investment amount, $ Live advisors available? Yes (for a fee). Wells. Ally Bank. Annual Fees: $0; Account type: Online Savings What's the Difference Between UTMA vs. UGMA Accounts? UTMA and UGMA. Ally Invest Fees Ally Invest offers commission-free stock trading and no minimum deposit. Majority of clients belong to a top-tier financial authority High. Here's what it could mean for your portfolio. The growing demand for LGBTQ+ investment options. A growing population of investors who ally with the LGBTQ+. Investment services at Ally Invest includes Self-Directed Trading, Automated Investing, and Personal Advice products at among the industry's lowest fees. The trading platform is less robust than those of financial firms such as E-Trade and TD Ameritrade's thinkorswim. vs Index Funds." The articles are. Ally Invest. “Investing with Us.” Retrieved March 4, (https://www Retrieved March 4, (z-x.site). E*TRADE is the more established and bigger broker with a huge number of customers compared to Ally Invest. Also their media exposure is higher with a bunch of. Ally Invest. E*TRADE Technical Details. Deployment Types, Software as a Service ETRADE has been a valuable platform for users, allowing them to easily. Ally Invest Managed Portfolio, Learn more. Annual advisory fee, 0% to %. Minimum investment amount, $ Live advisors available? Yes (for a fee). Wells. Ally Bank. Annual Fees: $0; Account type: Online Savings What's the Difference Between UTMA vs. UGMA Accounts? UTMA and UGMA. Ally Invest Fees Ally Invest offers commission-free stock trading and no minimum deposit. Majority of clients belong to a top-tier financial authority High. Here's what it could mean for your portfolio. The growing demand for LGBTQ+ investment options. A growing population of investors who ally with the LGBTQ+. Investment services at Ally Invest includes Self-Directed Trading, Automated Investing, and Personal Advice products at among the industry's lowest fees.

Etrade Core Portfolios focus on strategies that can be shy of high returns. alphaAI offers an alternative to investors with higher risk appetites. Brokered CDs vs. bank CDs: What's the difference? Brokered CDs and Ally Bank® is a Member FDIC. Annual Percentage Yield (APY). From % to. Ally Invest. Public. Robinhood. SoFi Invest. Wealthsimple. TC Chart: Michael Sacchitello / Investopedia Get the data Add this chart to your site. Is Etrade any good as a broker? Even though they are an old-school broker, E-Trade still has much to offer. Their trading platform is easy to use, has intuitive. Trade commission-free on eligible US securities with Ally Invest Self-Directed Trading. No account minimums to get started. V W X Y Z #. A. A+ Federal Credit Union; Abington Bank; ABNB; Academy Bank Ally Bank; Alma Bank; Aloha Pacific FCU; Alpine Bank; Alta Vista Credit Union. Ally Financial has a track record in banking, but investing and trading are somewhat new compared to its competitors, TD Ameritrade, Charles Schwab, and Etrade. How do I transfer an account from another broker? What is Ally Invest's DTC number? View all Transfers FAQs here! Etrade Core Portfolios focus on strategies that can be shy of high returns. alphaAI offers an alternative to investors with higher risk appetites. Ally Invest is known as a brokerage company that offers a variety of services to investors and traders, including beginners. E*TRADE offers stock trades at $0 per trade. There is a $ minimum deposit, no maintenance fee and no inactivity fee. While Ally Invest (formerly TradeKing). Saving vs. Investing. Both are ways to help you reach your short and long ETRADE Footer. About Us. Company Overview · Investor Relations · Newsroom. Ally also made itself one of the best brokers for mutual fund investing in by eliminating transaction fees on its more than 17, funds. Customer support. Pricing · With Ally Invest, there are no commission fees to trade exchange-listed stocks, ETFs and options. · Robinhood has no commission fees at all and no. Compare savings offers to see how much you can save. This calculator is Ally Bank. Current APY, %. Our top contenders, Evergreen Bank. Current APY. E-Trade; Interactive Brokers; Merrill Edge; Ally Invest; Tastytrade. The top online brokerage accounts for trading stocks in August An online broker is a. V. Buy-To-Open { "symbol TrendSpider and the TrendSpider logo are registered trademarks of TrendSpider LLC. Ally, Ally Invest, z-x.site and other Ally. Ally Invest. Public. Robinhood. SoFi Invest. Wealthsimple. TC Chart: Michael Sacchitello / Investopedia Get the data Add this chart to your site. Both Ally and TD Ameritrade are competitive, full-service brokers you can consider if E*TRADE isn't for you. Ally has many excellent banking offerings as. Before the court are is a motion to dismiss the complaint in the above-entitled action, filed by Ally Financial Inc. Plaintiff Phyllis Y. McGihon did not.